Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Camilla Knudsen of Reuters reports, Norway’s $870 bln fund sinks to first loss in three years:

Norway’s $870 billion sovereign wealth fund reported its first quarterly loss in three years on Wednesday, hauled down by sliding bond and stock markets.

The world’s richest sovereign wealth fund owns about 1.3 percent of all global equities and has massive government and corporate bond holdings, so its performance and decisions are closely followed by investors across the world.

It lost 73 billion Norwegian crowns ($8.8 billion) in the second quarter – representing a negative return of about 1 percent on its investments. That was the first drop the fund had seen since the same period of 2012 – and a dramatic reversal from the record 401 billion crown gain in January-March this year.

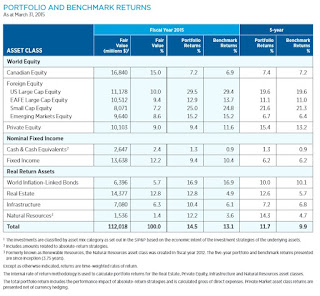

The value of the fund’s bond holdings – which account for about a third of its portfolio – fell by 2.2 percent in the April-June quarter as yields increased in its main markets, including the United States, Europe and Japan.

Its equities – which make up the bulk of its investments – lost 0.2 percent, hit by a decline in U.S. stocks, which outweighed gains in Asia and flat returns in Europe.

“The fund’s results during the last several years have come from a rise in stock markets and the simultaneous fall in long-term yields, in fact in all yields,” said Trond Grande, deputy CEO of the fund, which invests Norway’s oil and gas wealth.

Many investors expect the U.S. Federal Reserve to start raising interest rates later this year, which would push yields higher.

“It would very quickly hit the value of our bonds … In the short run it would necessarily have a negative development for the fund,” Grande said, adding that coupon payments made from bonds could be reinvested at a higher yield if rates rose.

He declined to comment on his expectations for the global economy or on the investment plans of the fund, which holds $167,000 for each of Norway’s 5.2 million people.

The value of the wealth fund’s real estate investments – which account for just a fraction of its portfolio – rose 2 percent in the second quarter.

A strengthening of the Norwegian crown reduced the value of the fund by a further 53 billion crowns in the period, but this is not counted as part of its negative return as currency movements are expected to even out over time.

Currency movements had led to an increase of 175 billion crowns in the previous quarter for the fund, which makes its investments in foreign currencies but assesses its own size in crowns.

The fund has cut its share of bond investments to 34.5 percent of its portfolio, from 35.3 percent at the end of March. Its equity investments have risen to 62.8 percent, from 62.5 percent; while its property holdings have increased to 2.7 percent, from 2.3 percent.

Yngve Slyngstad, the CEO of the giant fund, spoke with Bloomberg’s Manus Cranny in Oslo and stated that monetary policy and China are the biggest issues facing Norway’s sovereign wealth fund.

Interestingly, Bloomberg reported on Tuesday that despite the selloff, the world’s biggest sovereign wealth fund isn’t about to lose its faith in China and it’s prepared to increase its investment there:

The $870 billion fund, built on Norway’s oil riches, says the current selloff and policy shifts from China’s leadership won’t change its long-term view on the world’s second-biggest economy, where it’s prepared to increase its investment.

“We’re following the movements there and we see that they are steadily opening and taking steps in the direction of opening up the markets,” Ole-Christian Bech-Moen, chief investment officer of allocation strategies, said on Tuesday in an interview during a conference in Oslo. “We’re thinking long-term, so the short-term policies there and policy shifts — it’s not that important for the longer-term strategic thinking.”

After years of lobbying, the Norwegian wealth fund this year had its quota for investments in Chinese A shares lifted to $2.5 billion from $1.5 billion. It had about $27 billion invested in China and Hong Kong at the end of last year.

If China’s market becomes even more liberalized, “we know that it will be a big allocation” for the fund, Bech-Moen said.

The People’s Bank of China’s surprise decision last week to allow markets greater sway in setting the currency’s level triggered the biggest selloff in 21 years and roiled global markets. Since then, 10 emerging market nations have said they are particularly at risk since China’s yuan devaluation.

Henry Paulson

Norway’s wealth fund held 9.6 percent of its stocks and 12.9 percent of its bonds in emerging markets at the end of March. It has been increasing its investments in those markets as it tries to escape dwindling returns in the developed world.

“Capturing broader aspects of global growth is something where we have a very long horizon, so it’s not really governed by short-term fluctuations,” Bech-Moen said.

Chinese officials have a tough job in confronting the economic slowdown and undertaking market reform, former U.S. Treasury Secretary Henry Paulson said at a conference in Oslo hosted by Norway’s oil fund.

President Xi Jinping “understands the importance of fixing the economy,” Paulson said. “He has unleashed a massive reform agenda that goes way beyond the economy. It goes to every part of China — economic, social and political.”

Writing on pensions, I understand all about very long investment horizons but when you see the wealthiest investors in China bailing out of the market, you have to wonder whether the bursting of the China bubble has way more to go before things stabilize there (history has taught us that much).

At this writing, U.S. stocks are trading sharply lower on Wednesday morning after a wild trading session in China sent other Asian markets down and as Wall Street awaits the release of the Federal Reserve’s July meeting minutes.

Everybody is worried about China and the Fed, including the bond king who came out once again after his dire warning to basically state the Fed would be making a mistake hiking rates with junk bonds at a four year low:

DoubleLine Capital’s co-founder Jeffrey Gundlach warned on Tuesday that it might be premature for the U.S. Federal Reserve to raise interest rates next month, given junk-bond prices are hovering near four-year lows.

“To raise interest rates when junk bonds are nearly at a four-year low is a bad idea,” Gundlach said in a telephone interview.

Gundlach, widely followed for his prescient investment calls, said if the Fed begins raising interest rates in September, “it opens the lid on Pandora’s Box of a tightening cycle.”

Gundlach said the selling pressure in copper and commodity prices driven by worries over China’s growth outlook “should be a huge concern. It is the second-biggest economy in the world.”Last year, Gundlach correctly predicted that U.S. Treasury yields would fall, not rise as many others had forecast, because inflationary pressures were non-existent and technical factors, including aging demographics, were at play.

The Los Angeles-based DoubleLine Capital had $76 billion in assets under management as of June 30.

The DoubleLine Total Return Bond Fund (DBLTX.O), DoubleLine’s largest portfolio by assets and run by Gundlach, had positive inflows in July.

The Total Return fund attracted a net inflow of $390.4 million last month, compared with $81.7 million in June. It has $47.2 billion in assets under management and invests primarily in mortgage-backed securities.

I’m more convinced than ever the Fed has a deflation problem and it will be making a monumental mistake if it raises rates this year (Note: The Fed may have just gotten a red light for rate hike). The Wall Street green shoots keep telling us that everything is fine but I prefer reading Warren Mosler’s take on economic data, including his latest on U.S. housing starts and the Fed white paper, building permits, transport charts, Japan trade.

Stock markets around the world are doing what they always do, overreacting to news. Yesterday I noted that sentiment on emerging markets has reached a record low and I can pretty much say the same thing about the U.S. stock market where according to the Bank of America Merrill Lynch’s latest global fund manager survey, overall exposure to the US stock market moved to a 14% net underweight position, a level last seen in 2007.

The bears on Wall Street and around the world are growling, presenting some excellent buying opportunities for Norway’s sovereign wealth fund and other large global investors.

I continue to buy the big dips in biotech (IBB and XBI) and tech (QQQ) and steer clear of energy (XLE), mining and metals (XME) including gold (GLD) and pretty much anything related to commodities (GSC), emerging markets (EEM) and China (FXI). You can trade these sectors but be nimble and TAKE profits quickly.

Admittedly, my personal investment horizon is much shorter than that of pension or sovereign wealth funds, and part of me really loves trading these crazy schizoid markets.

As far as Norway’s sovereign wealth fund, its fortunes are inexorably tied to public markets. That is good and bad. During a real bear market where stocks and bonds get killed, it will grossly underperform its large rivals, including Canada’s two biggest pension funds which are diversified across public and private markets.

What is good about being tied to public markets? One word: liquidity. Some of Canada’s sharpest pension minds, like Ron Mock and Jim Keohane, have sounded the alarm on illiquid alternatives which include real estate, private equity and infrastructure.

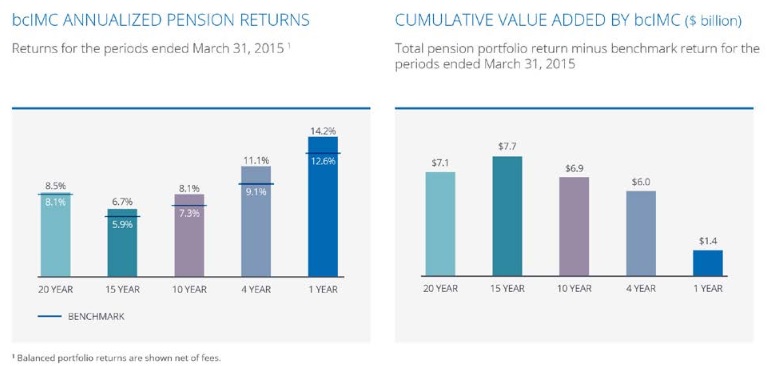

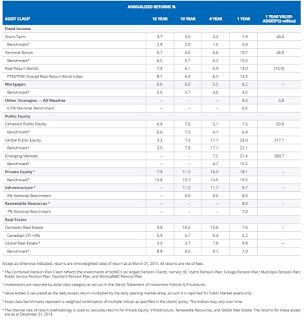

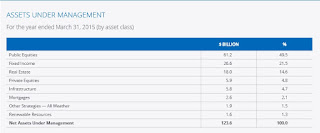

Of course, when it comes to performance, the proof is always in the pudding. Over a ten year period, Canada’s top large pensions have mostly outperformed Norway’s sovereign wealth fund, which goes to show you that diversifying intelligently (more direct investments, less fund investments) into private markets pays off when managing a huge portfolio.

Still, Norway is doing a lot of great things that others, including Canada’s large pensions aren’t doing. CBC News just reported that the Norwegian fund giant is putting a premium on ethical investing and this helps bolster returns. While I don’t doubt this, I caution investors and tree hugging vegans around the world, especially in British Columbia, to recognize the limits of so-called “ethical” investing.

There is one area where Norway is killing Canada, and I’m not talking about oil policy where we basically bungled things up again (learned nothing from our past mistakes). I’m talking about pension governance. I think we can learn a lot from Norway on this front.

In particular, Norway’s giant fund has great transparency and a solid governance model. I have long argued that Canada’s large public pensions need to improve on both of these fronts. I long to see the day where we cut the Office of the Auditor General and even the Office of the Superintendent of Financial Institutions out of auditing and supervising public and private pensions and put that responsibility squarely in the hands of the Bank of Canada like they do in Norway, the Netherlands and Denmark.

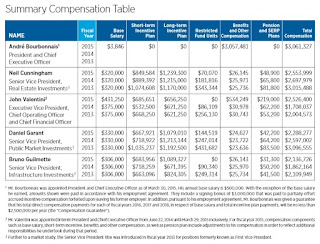

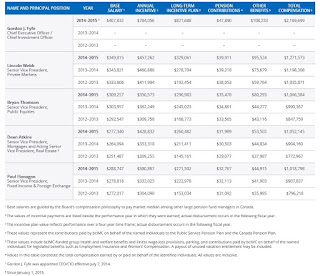

Canada’s pension plutocrats won’t like that last recommendation and they will tell you that keeping the government out of pensions is always the best governance, which is true, but I think things have to change a little to restore some balance in the way we govern our large public pensions and introduce more rigorous accountability and transparency in the way these large pensions invest and compensate their senior investment staff.

Hope you enjoyed reading this comment. Please remember to click on the ads and donate or contribute via PayPal on the top right hand side (of PensionPulse.com). As for Norway’s giant fund, feel free to contact me at LKolivakis@gmail.com as I’d love to work with you on all sorts of projects, including hedge funds, private equity, real estate, infrastructure and anything else.