Public pension plans are funded in part by state contributions. But, for various reasons, states often fail to make full payments into their pension systems and instead opt to use the money elsewhere in the budget.

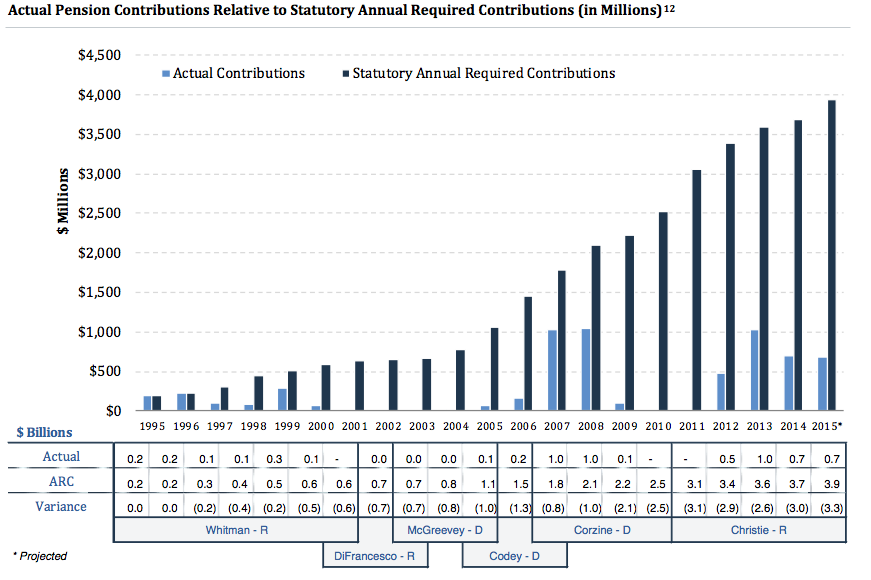

The above chart shows the payment history of New Jersey over the last 20 years. The dark blue bars represent the dollar amount the state was required to contribute to the system; the light blue bars show how much the state actually contributed.

The last time New Jersey paid its full pension payment was 1996. Since then, payments have fallen either well short or been non-existent.

New Jersey’s state-run pension systems were collectively 64.5 percent funded and were running a $47.2 billion deficit as of 2013.

Chart credit: New Jersey Pension and Health Benefit Study Commission report

I would.like to see this chart showing what would be the case if they had paid the ARCs.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

And I would like to see what the funding ratio on NJ’s Plans would look like if the ROOT CAUSE of Nj’s pension problems (grossly excessive pension promises … ALWAYS MULTIPLES greater in value at retirement than those granted comparable Private Sector workers) were never made and the pensions promised NJ’s Public Sector workers had always been EQUAL TO, but not greater than those of their Private Sector counterparts.

My guess is that they would be nearly fully funded even with the much lower contributions.

You see, the required funding is DIRECTLY proportional to the generosity of the promised pensions…… so looking at “funding” is wrong (as it FOLLOWS from Plan “generosity”).

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

You should probably check your facts before posting. See, e.g. http://njpp.org/assets/reports/NJPPPensionBenefitsDecember2014.pdf

“While one of the central tenets of repeated calls for major changes to New Jersey’s public pension system is the claim that public employee pensions are overly generous, retirement benefits for the state’s public workers are already among the least generous of all large public sector pensions in the country, in part because of cuts enacted in the pension reforms of 2011. In fact, New Jersey ranks 95th in pension generosity among the country’s 100 largest plans.”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Maybe you should understand that you are looking at NJPP, New Jersey Policy Perspective, an organization that is FUNDED by NJ Labor Unions !

Sorry, I would not consider anything out of them as a valid source to be quoted !

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

New Jersey’s enormous state aid to the Abbott districts is a major, perhaps _the_ major, cause of the pension crisis.

Check out the graph in this WSJ article. Notice how NJ’s pension contributions nosedive in 1992 and 1993.

http://www.wsj.com/articles/new-jersey-pension-woes-spur-blame-game-1401331289

That was because Florio and the NJ Supreme Court was determined to fund the Abbott districts at the same level as the richest districts. Florio wanted to pay for Abbott in three ways.

1. Offload $270 million in pension and Social Security payment that went to 220 wealthy and middle class districts to those districts themselves.

2. Redistribute $293 million in operating aid those same 220 districts and give it to the poorer districts.

3. Raise taxes by $2.8 billion on New Jerseyans of all economic classes. $1 billion of this would have gone to education and of that nearly $500 million would have gone to the Abbotts.

However, the NJEA was vehemently against #1, the suburbs were vehemently against #2, and the whole state was against #3.

Florio cancelled #1 and #2 himself, but the NJ Supreme Court would not listen to public opinion and continued its spending utopianism. Florio thus passed the Pension Reevaluation Act of 1992 in order to change the actuarial recommendations for pension contributions.

The PEA required $500 million less in pension payments per year. Whitman, who also wanted to comply with Abbott, but made even lower payments.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712