Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Heather Gillers of the Wall Street Journal reports, America’s Largest Pension Fund: A 7.5% Annual Return Is No Longer Realistic:

Top officers of the largest U.S. pension fund want to lower their investment targets, a move that would trigger more pain for cash-strapped cities across California and set an increasingly cautious tone for those who manage retirement assets around the country.

Chief Investment Officer Ted Eliopoulos and two other executives with the California Public Employees’ Retirement System plan to propose next Tuesday that their board abandon a long-held goal of 7.5% annually, according to system spokesman Brad Pacheco. Reductions to 7.25% and 7% have been studied, according to new documents posted Tuesday.

The last time the California system lowered its investment expectation was in 2012, when the rate was dropped to 7.5% from 7.75%.

The new recommendation comes just 13 months after the fund known by its acronym Calpers agreed to a plan that would slowly scale back its target by as much as a quarter percentage point annually—and only in years of positive investment performance. Now Mr. Eliopoulos and other officials are concerned that plan may not be fast enough because of a mounting cash crunch and declining estimates of future earnings.

“There’s no doubt Calpers needs to start aligning its rate of return expectations with reality,” California Gov. Jerry Brown said in a statement provided to the Journal.

The accounting maneuver would have real-life consequences for taxpayers and cities. It would likely trigger a painful increase in yearly pension bills for the towns, counties and school districts that participate in California’s state pension plan. Any loss in expected investment earnings must be made up with significantly higher annual contributions from public employers as well as the state.

“Lowering the rate of return sooner is undoubtedly going to make it more difficult for cities that are teetering on the edge financially,” said Bruce Channing, chair of the city managers’ pensions committee for the California League of Cities.

Nearly three quarters of school districts said in a survey conducted by Calpers that the impact of dropping the rate would be “high” or “extremely high.”

A drop in Calpers’s rate of return assumptions could also put pressure on other funds to be more aggressive about their reductions and concede that investment gains alone won’t be enough to fund hundreds of billions in liabilities. Because of its size, Calpers typically acts as a bellwether for the rest of the pension world. It manages nearly $300 billion in assets for 1.8 million members.

Pensions have long been criticized for using unrealistic investment assumptions, which proved costly during the last financial crisis. More than two-thirds of state retirement systems have trimmed their assumptions since 2008, according to an analysis of plans by the National Association of State Retirement Administrators.

The Illinois Teachers Retirement System in August dropped its target rate to 7% from 7.5% in August, the third drop in four years, and the fund’s executive director has said the rate will likely be reduced further next year. The $184 billion New York State and Local Retirement System lowered its assumed rate from 7.5% to 7% in 2015.

Amit Sinha of The Thought Factory blog also wrote an opinion piece for MarketWatch, What Calpers decides about its investment-returns forecast matters for pension plans (and taxpayers) across the U.S.:

The investment team at Calpers has been signaling that the current assumption of 7.5% long-term investment returns may be too high, and it would probably peg it around 6% instead.

The 7.5% rate is hardly unusual among government pension funds. But as the $300 billion gorilla in the pension world, any change — likely to be discussed at its Dec. 19 board meeting — will be watched by other pension plans that could then have a harder time justifying their own targeted returns.

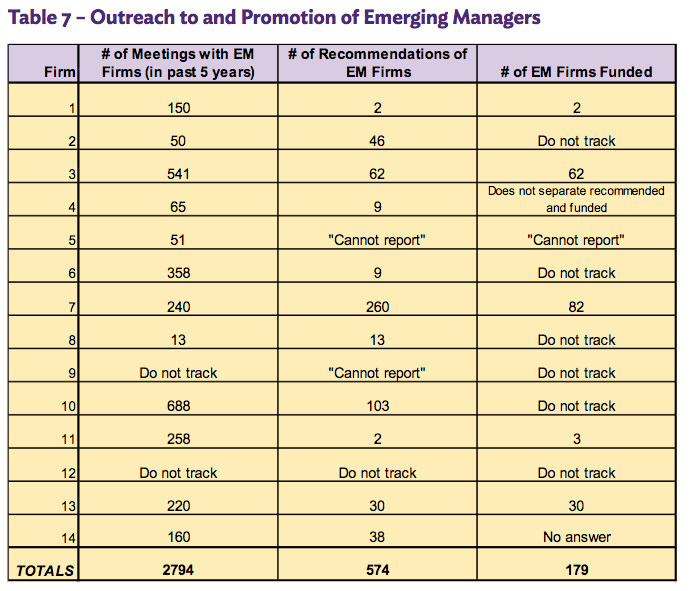

This chart of expected-return assumptions of some of the larger pension plans shows that while about 40% of the largest corporate plans assume returns 7% and below, only 9% of public pensions assume returns 7% and below (click on image).

There is an element of subjectivity in estimating future returns, and the decision comes loaded with behavioral and political implications. The number determines how well-funded a pension plan is, which in turn determines the amount a state or municipality needs to pay into their pension system. A higher number can make the pension plan appear healthier, requiring lower contributions today.

If the funded status appears artificially high, one risk is that officials can promise a level of benefits that they may be unable to maintain. In the future that can lead to higher taxes, fewer services and even a cut in actual pension benefits.

The flip side is that reducing the expected return to 6% may double the immediate contributions of some municipalities, according to Pension & Investments, adding to local budget stresses.

Look at what has been happening in Dallas over the past month. The troubled $2.1 billion Dallas Police and Fire System suspended lump-sum withdrawals and has asked the city for a one-time infusion of $1.1 billion, an amount roughly equal to Dallas’ entire general fund (but nowhere close to what the pension fund needs to be fully funded).

This case highlights two negative behavioral implications of using artificially high future investment assumptions to value pension benefits. First, the impression of being well funded can lead to making promises you cannot keep. In 1993 Dallas provided generous benefits without appropriately accounting for how it might be able to meet them. Second, expecting higher returns can drive money into riskier investments with the promise of higher returns. In the case of Dallas, the pension system invested in real-estate deals that didn’t deliver as expected.

My friend and author Ben Carlson has collated a few more examples of troubled pension plans here.

Widening out across the nation, the extent of underfunding is likely not $1 trillion across states — but $6 trillion.

Why is this?

The financially accurate approach to valuing future liabilities is using a discount rate that you are relatively certain of earning, such as a Treasury or high quality bond rate. Private pensions are required to account for their liabilities using high-quality bond rates. As the chart below shows, the rates that public pensions are required to use to account for their liabilities are significantly higher than the rates used by corporate pensions. This results in understating public pension liabilities, and creates an incentive to make expected returns as high as possible (click on image).

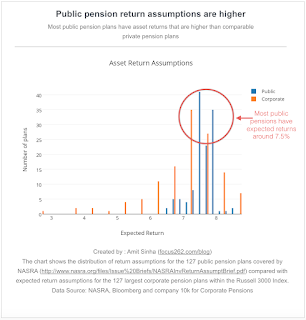

The investment consultant Callan Associates created this series of pie charts to highlight the increased complexity that pension plans need to take on in order to meet a 7.5% return assumption today. In January 1995, the 10-year Treasury yield was around 7.75%, allowing you to earn 7.5% returns over 10 years with relative certainty; currently it is just under 2.5%, thereby pushing investors into assets such as equities and alternatives that might provide higher returns, but come with greater risk. The S&P 500 for example, returned an annualized return of 10% since 1995, but came with higher volatility, including a 50% decline in value during the financial crisis (click on image).

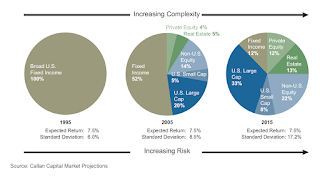

Calpers has a relatively well-balanced asset allocation, as this table shows, and shooting for higher returns would mean increasing the risk profile of the fund, which may not be prudent (click on image).

Critics of moving to a more financially accurate method of pension accounting rightly point to the immediate pain that would cause. If municipalities in California have to double their contributions by reducing discount rates from 7.5% to 6%, then it would be a disaster for them if they used a discount rate similar to that of corporate pensions.

However, there is something flawed in this logic. Instead of acknowledging the problem and then finding a solution, the critics would rather pretend the problem doesn’t exist. It’s the difference between “you owe $6 trillion, let’s work out a way for you to pay it off over time” and “you only owe $1 trillion, no big deal”.

Unless the true extent of underfunding is brought to light, we may be providing beneficiaries with a false hope that their promised benefits are secure. If taxpayers reach the limit of what they are willing to contribute, and state and federal governments are unable or unwilling to step in, then a cut in benefits may end up on the cards.

Even if over the next few years we see stellar investment returns (and I hope we do!), this conversation needs to happen. Instead of increasing benefits or reducing contributions, excess investment returns should be used to fill the widening hole. And the first step toward that is recognizing the size of that hole.

What Calpers decides to do with its expected-return assumption is likely to be a political decision, driven by compromise. The hope is that it can open up a much-needed debate that leads taxpayers, beneficiaries, pension committees and governments down the path of better understanding who is going to bear the risk of things not going as planned.

But if we hide the numbers, it’s hard to make the right decisions.

Amit Sinha has worked in the investment industry for over 16 years and in his spare time writes about bringing financial concepts, technology, design and behavior together. You can follow him on his blog The Thought Factory.

I’ve already covered why CalPERS needs to get real on future returns, stating the following:

The main reason why US public pensions don’t like lowering their return assumptions is because it effectively means public sector workers and state and local governments will need to contribute more to shore up these pensions. And this isn’t always feasible, which means property taxes might need to rise too to shore up these public pensions.

This is why I keep stating the pension crisis is deflationary. The shift from defined-benefit to defined-contribution plans shifts the retirement risk entirely on to employees which will eventually succumb to pension poverty once they outlive their meager savings (forcing higher social welfare costs for governments) and public sector pension deficits will only be met by lowering return assumptions, hiking the contributions, cutting benefits or raising property taxes, all of which take money out of the system and impact aggregate demand in a negative way.

This is why it’s a huge deal if CalPERS goes ahead and lowers its investment return assumptions. The ripple effects will be felt throughout the economy especially if other US public pensions follow suit.

Unfortunately, CalPERS doesn’t have much of choice because if it doesn’t lower its return target and its pension deficit grows, it will be forced to take more drastic actions down the road. And it’s not about being conservative, it’s about being realistic and getting real on future returns, especially now that California’s pensions are underfunded to the tune of one trillion dollars or $93K per household.

It’s not just CalPERS. From Illinois to Kentucky, US public pensions need to get real on future return assumptions or pray for a miracle that will never happen.

And the Dow 20,000 won’t save them or other pensions which are chronically underfunded. This too is a pipe dream which ignores the simple fact that no matter how good investment teams are at US public pensions, investment gains alone will never be enough to shore up public pensions over the long run.

Why? Because pensions are all about managing assets and liabilities. Those liabilities are long-dated (go out 75+ years) so for any decline in interest rates, the increase in liabilities is disproportionately larger than the gain in assets (in finance parlance, the duration of liabilities is much larger than the duration of assets, so any decline in rates will impact liabilities negatively more than it impacts assets in a positive way).

Now, a lot of people are getting excited about rates going up at the same time as assets going up. After the Fed raised rates on Wednesday, I was shocked to see how many industry professionals were parading in front of CNBC cameras claiming that “inflation concerns are on the rise” and the “Fed will surprise markets by raising rates a lot more aggressively in 2017″.

Total nonsense! Keep dreaming! I stand by everything I wrote last Friday when I went over the unleashing of animal spirits and think a lot of people aren’t paying attention to the surging greenback making a 14-year high (and going higher) and how it will tighten US financial conditions, lower US inflation expectations (via lower import prices) and hurt the domestic economy and possibly spur another Asian financial crisis, starting in China.

I know, president-elect Donald Trump and his powerhouse administration will “make America great again” allowing US public pensions to get back to the good old days when they were using 8%+ investment return assumptions to discount their future liabilities.

Like I said, keep dreaming, these markets seem so easy when they quietly keep rising but that’s when you need to be paying the most attention because the trend is your friend until it isn’t and when things shift, they shift very abruptly, especially when expectations are priced for perfection in terms of fiscal and monetary policy.

All this to say that 7.5% annualized return over the next ten years is a big pipe dream and no matter how much US public pensions allocate to illiquid or liquid alternatives, they will never attain this bogey without taking huge risks which will likely set them back further in terms of funded status.

I am open to all criticisms, suggestions, counterpoints, but I pretty much stand by everything I’ve written above and think that the day of reckoning for many US public pensions is right around the corner. Better to be safe than sorry which is why CalPERS is right to lower its future return assumptions. Others will necessarily have to follow or risk a much worse outcome down the road.

Let me repeat, I don’t care if you’re CalPERS, CalSTRS, Ontario Teachers’, HOOPP or if you have George Soros, Ken Griffin, Jim Simons, Steve Schwarzman and Ray Dalio all sitting on your investment committee, investment gains alone are not going to shore up your pension when times are tough, especially if it’s already chronically underfunded.

At one point, pension plans need to adjust benefits too or shore up public pensions via more taxpayer dollars. That’s when the real fun begins.