Pension reform has been the talk of Pennsylvania politics these last few months, and the reasons are equally political and practical: if retirement costs keep rising, the state’s fiscal handcuffs will keep tightening—and they are already uncomfortably snug. That leads eventually to budget-cutting maneuvers, many of which are sure to be politically unpalatable.

But a recent analysis from the actuaries for the state’s Public Employee Retirement Commission presents a policy tool to save the state money. The tool: pension obligation bonds (POBs), the controversial bonds that carry big risks and big rewards for the states that issue them.

The actuarial analysis stated that the state could save $24.5 billion over the next 30 years if they issued just $9 billion in POBs. The state’s PSERS system could reduce costs by $19.8 billion with POBs, according to the analysis.

More from the Pittsburg Post-Gazette:

The analysis does not account for the cost of the bonds, and the actuarial consulting firm, Cheiron, notes: “While the special funding provides a savings to the Systems, there is the potential for there to be a net cost to the Commonwealth.”

The governor’s budget office offered one analysis, from Public Financial Management, Inc., that projected borrowing $9 billion would require the state to pay $10.4 billion in interest over 30 years.

State and school district payments are scheduled to rise sharply in coming years, and policymakers face the prospect of searching for significant new revenues or exacerbating the estimated $50 billion unfunded liabilities of the retirement systems for state and public school workers.

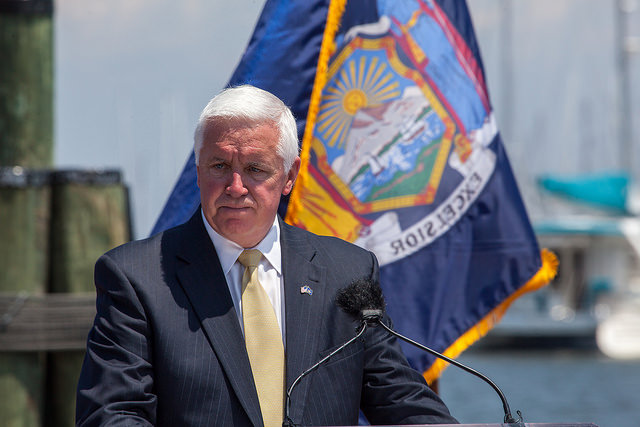

Gov. Tom Corbett, who is touring the state to promote another pension plan, has said he does not support borrowing to pay down the state’s pension liabilities, and House Republican leadership has not embraced the approach.

But Senate Democrats back refinancing the pension debt with $9 billion in bonds, and Tom Wolf, the Democratic candidate for governor, says he would explore funding mechanisms like pension obligation bonds. Mr. Wolf’s campaign said he favors following the payment schedule set in 2010.

The risks of POBs are well-known, and not everyone is on board with even considering this policy option.

One man, who says he has worked in the bond market for 50 years, wrote into the Post-Gazette to express his displeasure with the proposal. From the letter:

Issuing bonds provides elected officials a way to pay back the banks, investment houses and attorneys for their ongoing contributions to their election campaigns. Instead of having the courage to take steps to solve the current problems they will attempt to borrow their way out of the problem. It’s analogous to amassing large debt on your credit card, borrowing at high rates to pay off the debt and then continuing to use the card for new debt.

Colin McNickle, the editorial page director at Trib Total Media, weighed in on the issue as well this week:

First off, such bonds currently are not legal in the commonwealth. The state Legislature would have to reverse course. But, second, pension obligation bonds have a horrible history of failure because of their questionable application.

Such bonds are taxable general obligation bonds sold to investors. Governments see it as a reasonable way to shore up underfunded pension plans now while off-loading the costs to the future. And if that sounds financially hinky, you’re right.

“While POBs may seem like a way to alleviate fiscal distress or reduce pension costs, they pose considerable risks,” wrote scholars at Boston College’s Center for Retirement Research in a 2010 white paper. “After the recent financial crisis, most POBs issued since 1992 are in the red.”

Just last February, a panel commissioned by the Society of Actuaries warned that public pensions should not be funded with risk or if it delays cash funding: “Plans are not funded in the broad budgetary sense when debt is issued by the plan sponsor to fund the plan.”

As the Center For Retirement Research has previously pointed out, POBs often get a bad rap because they are “issued by the wrong governments at the wrong time.” Meaning, the states that issue POBs are often in states of fiscal distress and aren’t in a position to take on the risk posed by the bonds—even if they’re in the perfect position to benefit if the bonds work out.

So the question remains: Is Pennsylvania the right state? And is the right time now?

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712