Chicago politicians have been putting their heads together in recent months, trying to come up with ways to solve—or at least head off—the outstanding pension obligations that threaten to cripple the city’s finances.

A recent law mandates that the city make lump sum payments into the System each year to the tune of hundreds of millions of dollars. It’s up to lawmakers to find that money.

The first idea to increase was property taxes. But the move is so politically unpalatable that Illinois Pat Gov. Quinn struck a deal with Chicago: in exchange for the promise of no property tax increases, Quinn signed a bill that increased employee contributions to the city’s pension systems while also reducing employee benefits.

Now, many alderman have thrown their support behind a new idea for raising money: a telephone tax. More specifically, a 56 percent increase of the current telephone tax. From the Sun-Times:

Effective Sept. 1, the City Council’s Finance Committee agreed to raise the surcharge from $2.50 to $3.90–$1.40 more-per-month or $16.80-a-year–for every land line and cell phone in Chicago. The tax applied to pre-paid phones will rise from 7-to-9 percent, effective Oct. 1.

A family of four with four cell phones and a land-line would end up paying $84 in additional taxes each year. That’s $34-per-year more than the $50 price of Mayor Rahm Emanuel’s original plan to raise property taxes by $250 million over a five-year period to shore up two of Chicago’s four city employee pension funds.

On Tuesday, the Finance Committee honored the mayor’s promise without a single dissenting vote. That’s how eager they all are to avoid a property tax increase — the third rail of Chicago politics—seven months before the election.

The new revenue–$10 million this year and $40 million in 2015–will be used to “fully-fund” Chicago’s 911 emergency center and the Office of Emergency Management and Communications that runs it, thereby freeing up $50 million “to be contributed for the first payment” to reform the Municipal Employees and Laborers pension funds.

Taxing telephones is politically preferable to raising property taxes, which was the other option to raise funds to pay down Chicago’s outstanding pension obligation. Raising property taxes is a political no-no in the city.

But the telephone tax might turn out to be more costly, to both Chicago residents and the city itself. And some alderman have publicly wondered whether the city and the state are playing a political game. From the Sun-Times:

The fact that some Chicago families could end up paying more did not seem to bother most aldermen.

“Even though it may cost a little more because you have more lines and phones, I’d rather come up with an additional $5 or $10 than to come up with $150 [all at once]. It may not be as much pain monthly as it would be at one time,” said Budget Committee Chairman Carrie Austin (34th).

Budget Director Alex Holt added, “For some people, it may be more costly [than a property tax hike]. For others, it will be less costly. It’s going to be different for every home.”

Emanuel has emphatically denied that the phone tax was part of a political “shell game” to get past the Nov. 4 gubernatorial election and the Feb. 24 city election for mayor and aldermen, then sock it to taxpayers.

Ald. Scott Waguespack (32nd) said Tuesday he doesn’t buy it.

“We had this whole property tax issue on the table. Then, I thought I saw somebody [Emanuel] specifically say we’re holding it off for a year. Which means, it’s back on the table after the election,” Waguespack said.

“So, this is just to me sort of a short-term fix. It doesn’t solve the bigger structural problems we have. And it doesn’t put any other solutions on the table that we’ve had three years of talking about and haven’t proposed anything.”

Chicago’s largest fund, the Chicago Municipal Employees Annuity & Benefit Fund, was only 37 percent funded as of December 2012, according to the fund’s most recent annual report.

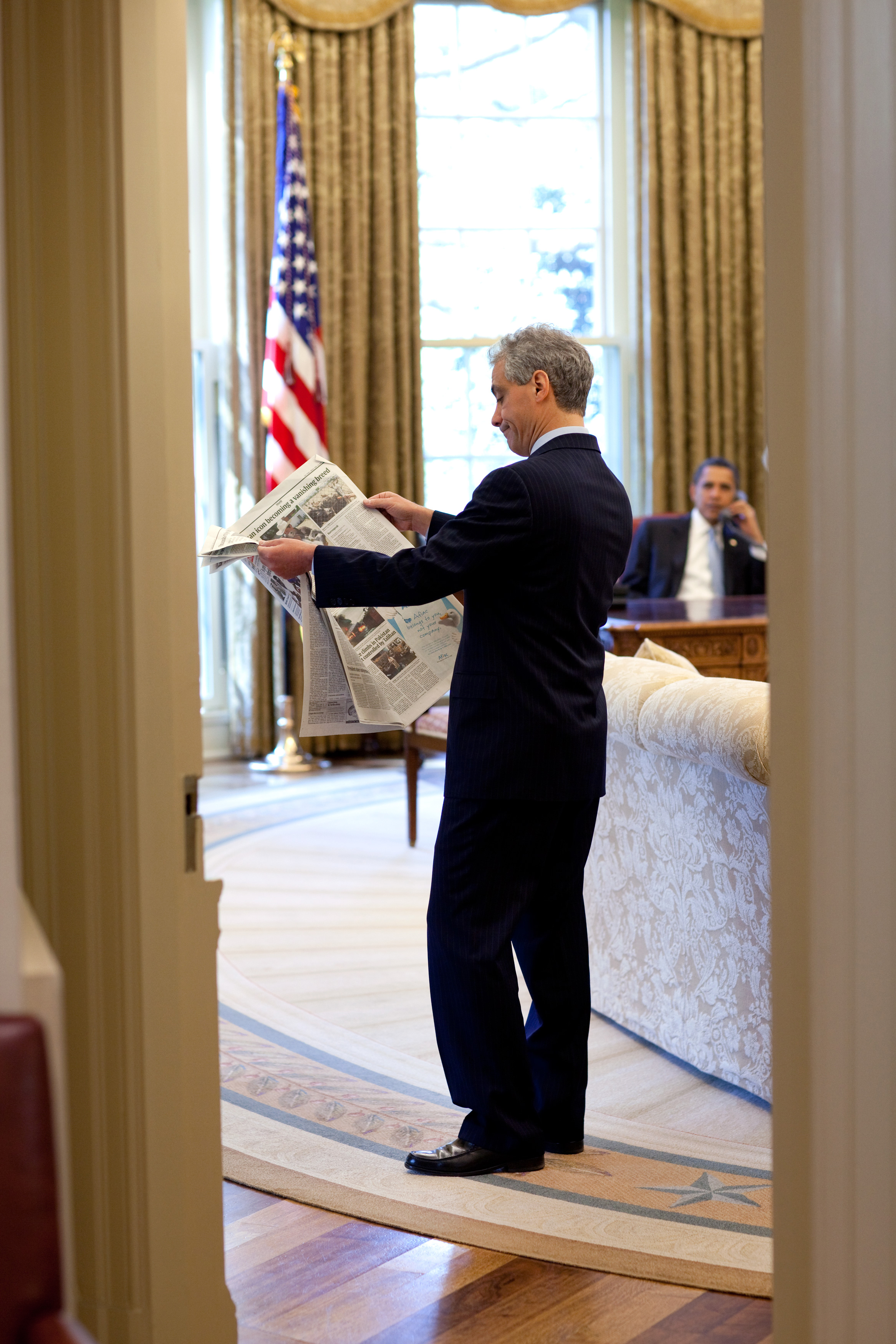

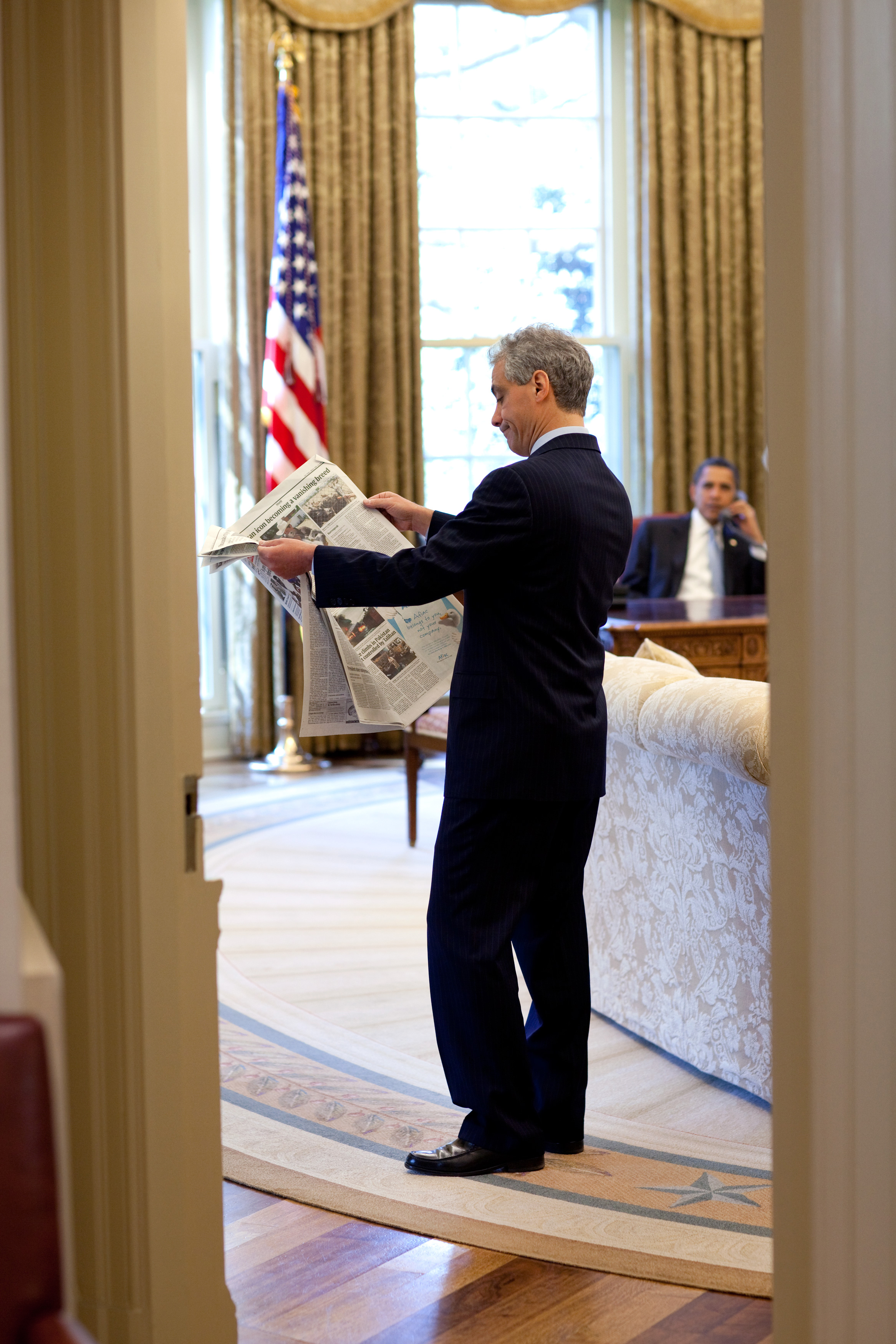

Photo: Pete Souza [Public domain], via Wikimedia Commons