In Chicago, property taxes are among the most politically unpalatable ideas one can bring to the table.

But Illinois law requires the city to dramatically increase its payments to its two major pension funds to the tune of $500 million by 2016. In the past, the city has levied property taxes a year or two in advance of the payments in order to fund the required contribution.

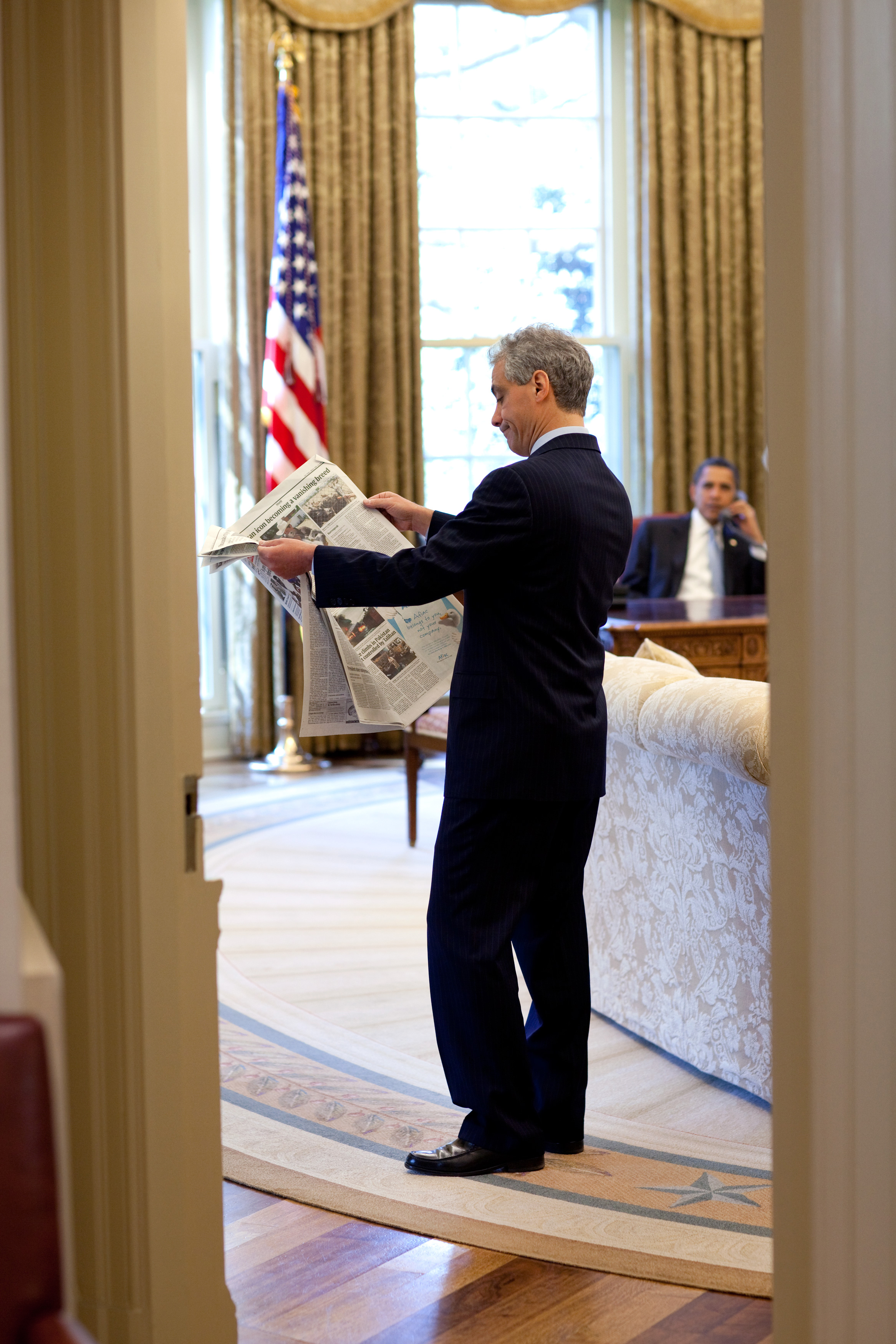

One glance at Chicago mayor Rahm Emanuel’s actions of late, however, confirms that property taxes remain off the table. Tasked with improving the fiscal health of the city’s pension systems, Emanuel is exhausting all his policy options—without turning to property tax increases.

From the Chicago Tribune:

Since taking office in 2011, Emanuel has cut the size of the city workforce, reduced health care costs and found other efficiencies, like organizing garbage collection by grids rather than a ward-by-ward basis.

The mayor also has increased a host of fees, fines and taxes. He’s held the line on property tax hikes at City Hall, though Chicago Public Schools has increased them under his tenure. Some revenues, like real estate property taxes, sales taxes and income taxes, have rebounded slightly as the economy has slowly improved.

Emanuel previously declined to identify any way to come up with additional city revenue for the city worker and laborers funds until he had worked out an overall pension change plan this spring that lowered annual cost-of-living increases for retirees and boosted employee pension contributions. He’s taking the same approach to police and fire pensions by declining to discuss additional revenue before an overall pension change plan is worked out.

Pension360 covered earlier this week a hike in telephone fees that will net the city $50 million this year and next.

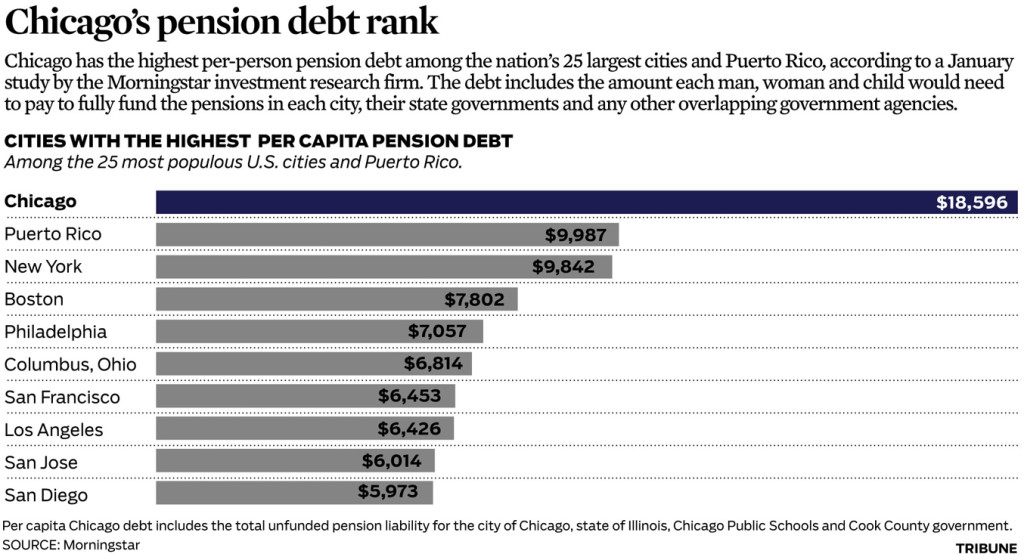

Still, Chicago’s budget gap is projected to be around $297 million in 2015. With the $500+ million pension payment looming as well, the pressure is mounting and Chicago officials may have to make some politically unpopular decisions.

City officials can still change their minds and hike property taxes—but the deadline to do so is last Tuesday of December 2015.