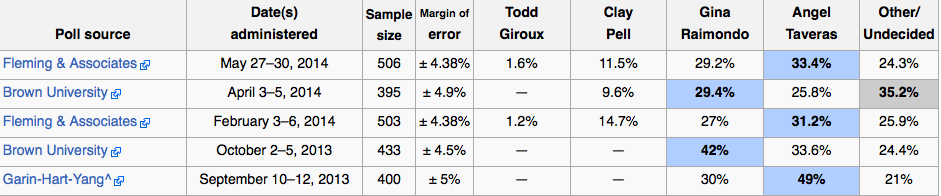

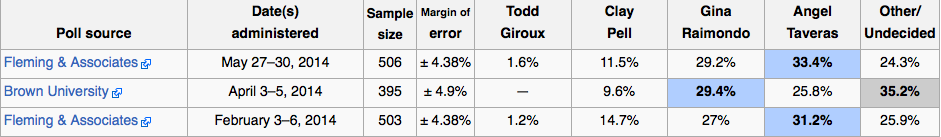

Rhode Island Governor candidate Gina Raimondo has beaten out challengers Angel Taveras and Clay Pell to win the state’s Democratic Primary. From Politico:

With 96 percent of precincts reporting, Raimondo led Providence Mayor Angel Taveras, 42 percent to 29 percent, with first-time candidate Clay Pell at 27 percent.

Rhode Island Democrats are hoping Raimondo can break a long streak of gubernatorial heartbreak: It’s been since 1992, when Bruce Sundlin earned a second two-year term, that a Democrat won an election for governor. Current Gov. Lincoln Chafee, who is not seeking reelection, took office as an independent but later became a Democrat as he pondered his electoral future.

The primary was of particular interest because of the pension issues surrounding the candidates, and the lack of public-sector union support for Raimondo.

Some further analysis of the outcome, courtesy of Daniel DiSalvo at Public Sector Inc:

Raimondo won for three reasons. First, in a three way race that included the Mayor of Providence Angel Taveras and Clay Pell, the 32-year old scion of former Senator Claiborne Pell, Raimondo enjoyed greater name recognition and outraised and outspent her opponents.

Second, the Ocean State’s public employee unions were divided between Taveras and Pell. Traveras had run afoul of the state’s teacher unions after a labor dispute in Providence and he had also supported pension reform, albeit a milder version than Raimondo. In short, the unions could either back Pell–the least experienced candidate–or they could chose between pension reformers. Some went for Pell, most notably the teacher unions, and others for Taveras. The lack of unity weakened the force of the public employee voting block.

Third, the labor movement was divided between public and private sectors–a phenomenon that has occurred frequently in recent years. Many private sector unions, concerned about the state’s business climate, backed Raimondo.

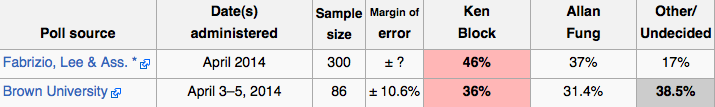

Raimondo will face Allan Fung in the general election. Fung, who is currently the mayor of Cranston, defeated Ken Block in the Republican primary.