The New Orleans Municipal Employees Retirement System returned less than 5 percent in 2014, a number that is pushing some board members – including the city’s finance director – to consider a more passive investment strategy.

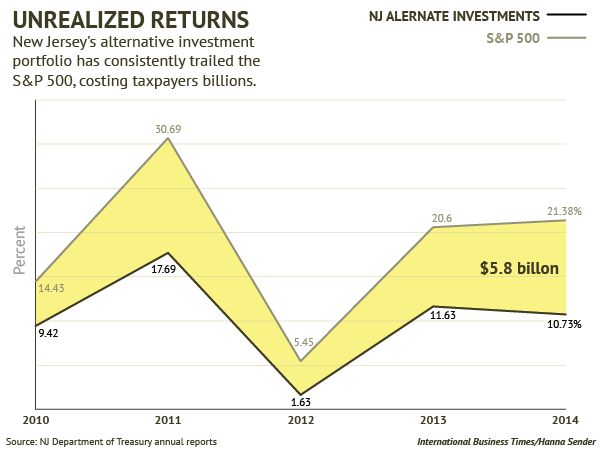

Trustee and city finance director Norman Foster argued this week that the fund should be investing in funds that passively follow indices like the S&P 500, which saw double digit returns in 2014.

From NOLA.com:

Several board members expressed some frustration with the fund’s investment performance, none more than Norman Foster, the city’s finance director.

Foster argued that the city would have been better served by investing in index funds, passive investment vehicles that track the market and eliminate costly management fees. “I’ve made the case for passive investment, and I’ll be making it more and more,” he said.

[…]

Some of the performance lag can be attributed to the fund’s asset mix. Like many pension systems, the retirement system invests heavily in bonds, a strategy that minimizes risk but also limits returns during market booms.

Foster pointed out, however, that even when the asset mix is taken into account, the fund’s performance fell short of index benchmarks by nearly 3 percent, which means the managers failed to beat the market, despite collecting handsome fees.

Ian Jones, who advises the retirement system on investment issues, warned against dumping its asset managers based on one year’s worth of data.

The fund assumes a 7.5 percent annual return.

Over the past seven years, the fund’s returns have averaged 4.21 percent annually.

Photo by www.SeniorLiving.Org