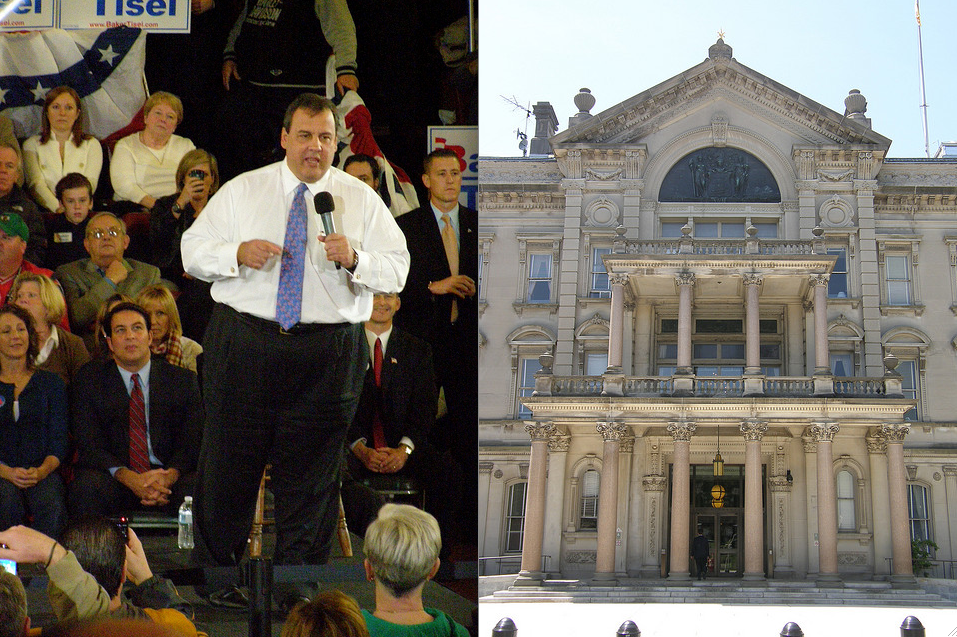

By now, you know the story: New Jersey Gov. Chris Christie’s plan to cut pension funding by $2.4 billion over two years has been met with controversy, outrage, a string of lawsuits and numerous legal questions.

The answers to some of those legal questions may come as soon as Wednesday, when Christie’s plan will see its first day in court.

But outside the courtroom, a new bill is gaining steam among state lawmakers—a bill that finally puts a tangible, short-term solution on the table. And even if it doesn’t come without its kinks, it’s the first plan that has been offered up to counteract Christie’s measure. (More on the bill below).

Meanwhile, more data is emerging on the true costs of Christie’s plan. Spoiler alert: the snowball effect is real, and it’s prohibitively expensive.

Cuts Bring Consequences, Now and in the Future

Every passing day brings a bit more clarity as to just how expensive Christie’s plan to cut pension funding by $2.4 billion would be. In a bond disclosure released by the state, the ramifications of the cuts are outlined in four points.

The proposed reduction in contributions…could have the effect of (1) delaying the phase-in of the State’s full actuarially required contribution, (2) increasing the amount of such contribution, (3) increasing the size of the UAAL and (4) decreasing the percentage of the Funded Ratio of the Pension Plans once the phase-in is completed.

Indeed, New Jersey can expect all four of those points to materialize, some sooner than others. And when you attach numbers to them, the urgency of New Jersey’s upcoming fiscal situation really starts to set in. If Christie goes through with his plan, here’s what New Jersey could be facing in fiscal year 2019:

- The state’s actuarially required contribution would be $4.8 billion—for context, that sum would represent 26 percent of New Jersey’s general fund budget, based on 2012 expenditures.

- The unfunded liabilities of the state’s pension plans would total $46 billion. Christie could decrease these liabilities by $4 billion if he scrapped his plan to cut contributions by $2.4 billion in 2015-16.

- The funded ratio of state plans would drop to 48.25 percent. The funded ratio sat at 67.5 percent in 2011.

Rest assured, Christie has seen these numbers—they came from his own financial team.

A New Bill Emerges in the Legislature

On Monday, news broke that New Jersey state legislature had agreed on an alternate budget proposal that would raise enough revenue to cover the state’s full contribution to the pension system, a payment that Christie’s plan had drastically cut.

Sources inside the legislature told the Star-Ledger that Democrats in the state Senate and Assembly had reached a deal to raise more than $1.3 billion in revenue—money that would cover the state’s full annual contribution of $2.25 billion to the pension system. Christie’s plan had cut that payment down to just $681 million.

The revenue would come from tax increases on high-income earners and businesses, among other things. From the Star-Ledger:

Under the Democrats’ budget:

• The marginal tax rate on income above $1 million would rise from 8.97 percent to 10.75 percent, retroactive to January of this year, netting $667 million.

• The corporate business tax would rise from 9 percent to 10.35 percent, yielding $375 million.

• The Business Employment Incentive Program (BEIP) of tax abatements would be suspended for a year, freeing up $175 million.

• A tax hike on income between $500,000 and $1 million that Sweeney had proposed would be scrapped, as Prieto suggested.

In addition, some new taxes or fees Christie proposed would be folded into the Democrats’ budget, such as a penalty for making bad electronic payments ($25 million) and a move to subject all online retailers to the state sales tax ($25 million).

Taxes Christie proposed on electronic cigarettes and the Urban Enterprise Zone program would be cut out of the budget under the Democrats’ deal.

Of course, the deal doesn’t come without its hitches. Despite the bill’s focus on raising revenue, it actually earmarks more money toward several of the areas that Democrats lost out on in the last budget dealings: the new bill restores funding for the Earned Income Tax Credit, nursing homes, legal services for the poor, and women’s health care centers.

Those are all items that deserve funding, but their inclusion makes the bill much less politically palatable to lawmakers on the other side of the aisle. Of course, it was already unpalatable to politicians who, on principle, oppose tax increases.

Indeed, state Republicans are none too happy about the proposed measure.

“It would be suicidal to…New Jersey’s economy,” said Assemblyman Declan O’Scanlon (R-Monmouth) during a Monday morning press conference.

The Democrats would likely be able to overcome Republican opposition. They hold 48 seats (60 percent) in the General Assembly, and 24 seats (60 percent) in the Senate.

The Senate and General Assembly are holding hearings on the bill Tuesday, and the measure is expected pass by vote through the two houses by Thursday.

Still, the chances that the bill becomes law in its current form, or at all, are slim. That’s because the buck stops with Gov. Christie, who has line-item veto power and has repeatedly states he will oppose any tax hikes on wealthy individuals or businesses.

Lawmakers have until July 1 to pass a new budget.

Photo by Jim Bowen and Marissa Babin via Flickr Creative Commons License