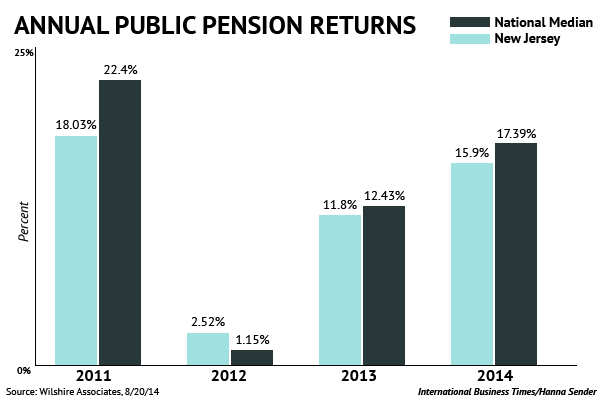

Amidst all the pension-related turmoil in New Jersey, a piece of bright(er) news: the state’s pension fund raked in double-digit returns for fiscal year 2013-14, which ended June 30. The fund returned more than double the actuarially assumed rate of return, although the S&P 500 returned about 25 percent over the same period.

From Bloomberg:

New Jersey’s pension fund return is expected to exceed 16 percent for fiscal 2014 on gains that include an unanticipated $6.1 billion, according to the state Treasury Department.

Data as of June 30, which exclude some investments reported on a delayed basis, showed returns of 15.9 percent, treasury officials said in a statement. The fund’s total value was $80.6 billion, up from $66.9 billion four years earlier. The state investment division will report the performance to its oversight council at a meeting tomorrow.

Interestingly, unions are now presenting the argument that the strong returns only further demonstrate the need for the state to make its full contributions into the system. From NorthJersey.com:

The impressive returns, however, highlight an argument from unions that New Jersey may have missed out on even bigger gains in recent years because state contributions into the pension fund have been reduced or cut altogether, including the payment Governor Christie slashed at the end of June. Christie said he cut that payment — from a planned $1.57 billion, to $697 million — to prevent tax hikes or funding cuts to schools, hospitals and other crucial services amid a $1 billion budget shortfall.

New Jersey’s actuarially assumed rate of return stands at 7.9 percent.