Last week, Pennsylvania Gov. Tom Wolf released his first budget proposal.

Wolf has said many times that he doesn’t support a full overhaul of the state’s pension system. But his budget did contain some pension-related changes.

Wolf is calling for the state’s pension funds to take a more passive approach to investing and to cut down the fees it pays to managers. The proposal was short on specifics but called for the funds to “prudently maximize future investment returns through cost effective investment strategies.”

PhillyDeals columnist Joseph N. DiStefano talked to spokesman for the state’s two pension funds – SERS and PSERS – and got their official reactions to the budget proposal.

SERS reaction:

“We are working to gather details on the Governor’s plan, so I can’t speak to it specifically,” SERS spokeswoman Pamela Hile told me. “What I can tell you is that last year, a little more than 0.5% of the total fund value went to management fees. This, in the view of the Board, does not represent an excessive amount.”

“Looking at the issue from a long-term perspective, over the past decade, SERS paid $2.4 billion in fees, while earning $19.7 billion net of fees and expenses AND paying out $23.2 billion in retirement benefits.

“Compare that performance to an industry standard 60% equity/40% bond index fund, SERS’ performance added $4.9 billion of value to the fund with 0.5% less volatility.

“To further illustrate this value, our alternative investment program, built with top-tier investment managers, outperformed the U.S. public market equities return by 5% net of all fees over the decade ended 2013… Over the past five years, we reduced fees 30%. We get good value for the fees we pay…

“In 2013, SERS earned $3.7 billion, after all investment management fees and expenses of $175 million were paid. From a basic dollar perspective, that’s like paying $175 over the year to net $3,700 in your pocket at the end of the year.”

The PSERS spokesperson told DiStefano:

“We are not aware of the details of the Governor’s proposal on investment management fees. We have not met with him,” and won’t comment on details of the proposal until they are available.

“Our investment management fees are not excessive relative to the incremental value generated. PSERS paid $482 million in investment expenses for the fiscal year ended June 30, 2014. This amounts to 0.93% of our fund.

“By spending those fees, we earned an additional $1.27 billion (net of fees) ABOVE the index return,” Williams added in an email. “We would not have that additional $1.27 billion or 2.8% in additional investment performance if we did not use active managers.

“Looking longer term for the past 15 fiscal years (2000-2014), PSERS incurred $4.96 billion in investment management fees. In exchange for those fees, the Fund received the index returns plus an additional $16.42 billion in excess performance gross of the fees incurred. So, net of fees, PSERS generated $11.46 billion of incremental performance above the applicable index returns.

Read more of their remarks, including reaction to Wolf’s pension bond proposal, here.

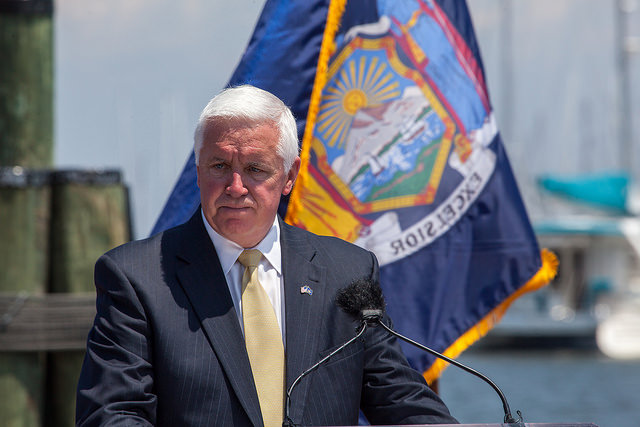

Photo by c_ambler via Flickr CC License