If oil, gas and coal companies were to face serious financial difficulty, the average person might anticipate the annoyance of a higher heating bill, or having to cough up more cash to fill up at the gas station.

They probably don’t think about their pension—but maybe they should.

Earlier this year, members of the British Parliament sent out a clear warning to the Bank of England and the country’s pension funds: watch out for the carbon bubble.

The “carbon bubble”? Here’s a quick explanation from the Guardian:

The idea of a carbon bubble – meaning that the true costs of carbon dioxide in intensifying climate change are not taken into account in a company’s stock market valuation – has been gaining currency in recent years, but this is the first time that MPs have addressed the question head-on.

Much of the world’s fossil fuel resource will have to be left unburned if the world is to avoid dangerous levels of global warming, the environmental audit committee warned.

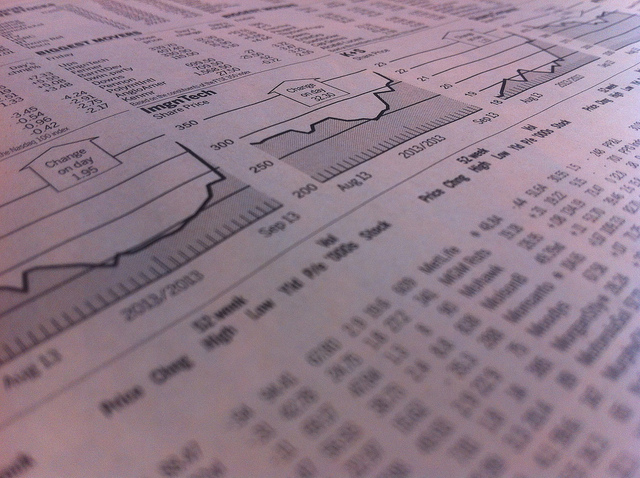

To many, it probably sounds like a silly term. But its potential implications are serious enough that many in the UK are starting to worry about its effect on the global economy, and that includes pension funds—UK pension funds are particularly exposed to fossil fuel-based assets, as some estimates say 20 to 30 percent of the funds’ assets are allocated toward investments that would be seriously harmed by the burst of the “carbon bubble”.

But some experts say pension funds in the US should be worrying about this, too, because it’s a global issue. From The Ecologist:

If the impetus to prevent further climate change reaches the point where measures such as a global carbon tax are agreed, for example, then those fossil fuel reserves that have contributed to the heady share price performance of oil, gas and coal companies will become ‘unburnable’ or ‘stranded’ in the ground.

But even if we continue business as usual, value could begin to unravel.

Because to continue with business as usual would require an ever increasing amount of capital expenditure by the industry to explore territories previously off limits – the Arctic, for example and the Canadian Tar Sands – tapping these new resources, quite apart from being a bad idea environmentally, is hugely expensive.

Dividends – the payments earned by shareholders as a reward for keeping their shares, have come under increasing pressure as companies have had to spend their money on more exploratory drilling rather than rewarding shareholders.

So some shareholders are already feeling the impact and rather than see their dividends further eroded, might prefer to sell their shares in favour of a more rewarding dividend stock.

Some don’t have the stomach for all those hypotheticals. But it’s hard to deny the policy shifts in recent years leading us towards a lower-carbon world. That includes regulation in the US, Europe and China that cuts down emissions and encourages clean energy.

That trend doesn’t look to be reversing itself in the near future, and those policies are most likely to hurt the industries most reliant on fossil fuels.

There’ve been calls in the US for public pension funds to decrease their exposure to those industries. From the Financial Times:

US pension funds have ignored calls from city councils and mayors to divest from carbon-intensive companies, despite concern about the long-term viability of their business models.

At least 25 cities in the US have passed resolutions calling on pension fund boards to divest from fossil fuel holdings, according to figures from 350.org, a group that campaigns for investors to ditch their fossil fuel stocks.

Three Californian cities, Richmond, Berkeley and Oakland, urged Calpers, one of the largest US pension schemes, with $288bn of assets, and which manages their funds, to divest from fossil fuels. Calpers has ignored their request.

Calpers said: “The issue has been brought to our attention. [We] believe engagement is the best course of action.”

Pension fund experts point out that it is difficult to pull out of illiquid fossil fuel investments, or carbon intensive stocks that are undervalued, provide stable dividends or are better positioned for legislative change.

CalPERS isn’t the only fund that doesn’t want to divest. Not a single public fund has commited to divesting from carbon-reliant companies.

To some, CalPERS’ policy of “engagement” rather than divestment probably sounds like a cop-out. But some experts think the policy could be effective.

“With divestment you are not solving the problem necessarily, you are just not part of it.” Said George Serafeim, associate professor of business administration at Harvard Business School. “With engagement you are trying to solve the problem by engaging with companies to improve their energy efficiency, but you are still part of the mix.”

Photo: Paul Falardeau via Flickr CC License