No one ever said Wall Street wasn’t creative.

Several firms are selling securities backed by longevity risk—the risk that retirees receiving benefits will live longer than expected and thus incur a higher cost on their retirement plan. More from Institutional Investor:

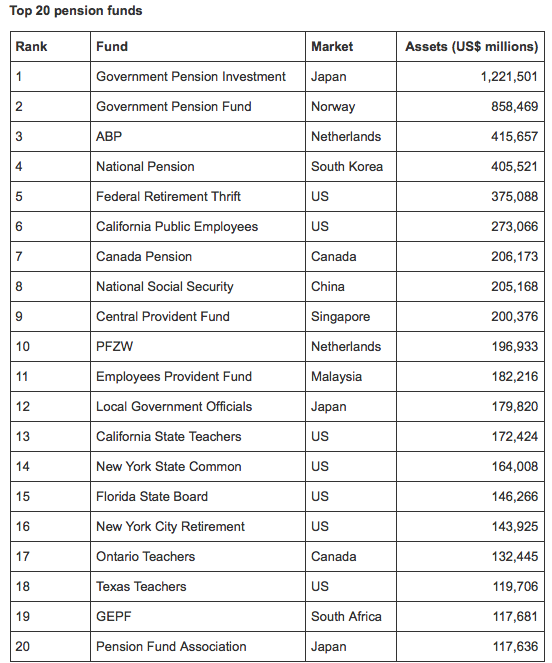

Sovereign wealth funds, educational endowments and ultrahigh-net-worth individuals are the target investors for longevity derivatives, which package the risk that retirees drawing annuities will outlive actuarial expectations.

The roots of this nascent market date back to 2006, when small monoline insurance companies such as U.K.-based Lucida (purchased by Legal & General in June 2013) and Paternoster (bought by Goldman Sachs Group in 2011) began taking longevity risk off European pension funds through bulk annuity buyouts.

These buyouts entail a company selling pension assets earmarked for all or some of its plan participants. The assets are converted to annuities that the sponsor can keep on its books or off-load to the insurer.

[…]

Banks build longevity derivatives products using risk models provided by firms like Newark, California–based Risk Management Solutions (RMS). They’ve closed a dozen such deals, but the customized structure can be tough for investors to grasp. Deutsche Bank is focused on creating a path into the capital markets, according to Paul Puleo, global head of pension and insurance risk markets in New York.

In December 2013, Deutsche created longevity experience options, or LEOs, a more standardized product tailored to capital markets participants. Longevity derivatives resemble the older catastrophe bond, or insurance-linked security (ILS), market, which packages insurance against natural disasters. A key difference between longevity insurance derivatives and cat bonds is that there are now a number of hedge funds dedicated to the ILS market.

Who buys these securities? It’s been mostly life insurers so far. But firms anticipate other interested parties will soon be buying up these instruments, as well. From Institutional Investor:

Although it’s been difficult for capital markets participants to compete with such natural buyers, long-term investors like sovereign wealth funds may find the portfolio diversification attractive. Ultrahigh-net-worth investors might also be interested, says Peter Nakada, Hoboken, New Jersey–based head of the life risks and capital markets units at RMS. These products can be viewed as a social good because they provide insurance for people who may not have enough cash in retirement, Nakada posits: A wealthy individual makes good money now by purchasing them; in the unlikely event that retirees exhaust their annuities, the monetary outlay can provide financial relief to the needy elderly.

The firms selling these instruments seem to realize the market is “immature” and it will take investors a while to warm up to them. But several industry sources told Institutional Investor they see longevity derivatives as a diversification tool and a good fit for portfolios of endowment funds and even high-worth individual investors.