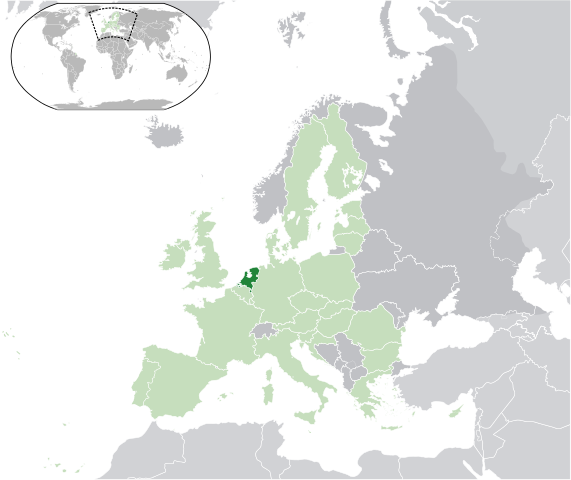

The funding ratios of Dutch pension funds have fallen on average by 5 percentage points in January on the back of low interest rates, according to Mercer and Aon Hewitt.

More from Investments & Pensions Europe:

Average funding, according to estimates by Aon Hewitt and Mercer, fell by 5 percentage points over the period, due to persistently low interest rates, the criterion for discounting liabilities.

[…]

The consultancies also attributed the sudden drop in funding to a new accounting method for calculating coverage ratios.

Since 1 January, when the Netherlands introduced its new financial assessment framework (FTK), schemes’ funding has been based on actual interest rates while applying the ultimate forward rate (UFR), rather than the three-month average of interest rates plus UFR.

In addition, the new FTK came with a ‘policy funding ratio’ – meant as a criterion for rights cuts and indexation – consisting of the average coverage of the previous 12 months.

According to Aon Hewitt, policy funding stood at 109% at January-end, while Mercer placed the figure at 109.6%.

[…]

[Aon Hewitt chief commercial officer for retirement and financial management Frank] Driessen said the ECB’s recently announced quantitative-easing programme had led to a further slide of interest rates and predicted that rates would remain low for “a long time”.

The average funding ratio of Dutch pensions stood at 103 percent at the end of January, according to Aon Hewitt.