Josephine Cumbo of the Financial times reports, Pensions review recommends later retirement age:

Millions of people should have their state pension age pushed back a year to 68 to cut the UK’s £100bn a year pension costs, according to an independent review commissioned by the government.

John Cridland was appointed to review the state pension age and has recommended it should rise from 67 to 68 by 2039, seven years earlier than currently timetabled.

Experts said this would affect about 5.4m people aged under 45. The current pensionable age is 63 for women and 65 for men, rising to 65 for both by late 2018, 66 by 2020, and age 67 by 2028.

Mr Cridland has also recommended that the “triple lock” — which raises the state pension by whichever is the highest of average earnings, prices or 2.5 per cent — be scrapped in the next parliament and replaced with a link to earnings.

“This report is going to be particularly unwelcome for anyone in their early 40s, as they’re now likely to see their state pension age pushed back another year,” said Tom McPhail, head of retirement policy at Hargreaves Lansdown.

Mr Cridland said his timetable would reduce state pension spending to 6.7 per cent of gross domestic product in 2066-67 — 0.3 per cent less than forecast by the government’s fiscal watchdog the Office for Budget Responsibility — or 5.9 per cent of GDP if the triple lock is also abolished. This financial year, state pension spending was 5.2 per cent of GDP.

“My review considers the consequences of an ageing society,” said Mr Cridland, a former head of the CBI business lobby group. “The aim is to smooth the transition for tomorrow’s pensioners, and to try and make the future both fair and sustainable.”

Britain’s demographic profile is of an ageing society in which people are also living longer: the number of 100-year-olds is expected to rise from 6,000 today to 56,000 by 2050.

Along with Mr Cridland’s recommendations, ministers will also consider a report from the Government Actuary’s Department, which projected state pension age rises on the basis of everybody being in receipt of the state pension for either 32 or 33.3 per cent of their adult life.

Sir Steve Webb, a former pensions minister, said that if the government went ahead with “a more radical” timetable for pension age increases (based on 32 per cent of adult life in retirement) “they would be guilty of misleading parliament”.

“In the last parliament, MPs voted for the new arrangements on state pension age increases, on the basis that people would spend two years in work for every one year in retirement,” said Sir Steve, now director of policy at insurance company Royal London.

“On this basis, no one at work today would have a pension age of 70. But on the more aggressive schedule that the government is considering, everyone in their twenties would have a pension age of 70.”Mr Cridland’s report does not recommend any changes before 2028.

He has rejected calls for early access to the state pension for people in poor health. But said additional means-tested support should be made available one year before state pension age — effective from when state pension age reaches 68 — for those who are unable to work longer because of ill health or caring responsibilities.

“As government goes about making its decision on the future state pension age in May of this year, these contributions and recommendations will provide important insight,” said Damian Green, secretary of state for work and pensions.

Sarah O of the Express reports the new proposals to reform UK’s state pension isn’t going well with retirees furious over planned cuts:

A review of the age at which people can receive their state pensions also recommended the axing of the ‘triple lock’ which guarantees that pensions rise by the same as average earnings, the consumer price index, or 2.5 per cent, whichever is the highest.

But the UK’s biggest pensioner organisation, the National Pensioners Convention described the Cridland Review as “asking all the right questions, but coming up with the wrong answers”.

Jan Shortt, the new general secretary of the NPC, said: “It seems strange that in his first report, John Cridland went a long way to dispel the myth of generational unfairness, showing that the majority of baby boomers, and those from generations X, born in the 60s and 70s, will get the bulk of their income in retirement from the state pension.

“But he bizarrely ends up recommending that everyone should see the value of their state pension fall by axing the triple lock.”

“He has clearly asked the right questions, but come up with the wrong answers.”

“There can be little doubt that the future of the triple lock will now become a key election issue in 2020 for all generations.”Caroline Abrahams, charity director at Age UK agreed, saying: “We are firmly of the view that the triple lock needs to stay in place, because it is not yet ‘job done’ when it comes to eradicating pensioner poverty.

“Sixteen per cent of older people are still poor and figures published just last week suggest a rise in pensioner poverty.”

“Looking ahead to 2039 and beyond, we think it is crucial that the state pension continues to retain its value so that the people who retire then can look forward to their later lives with confidence, not fear.”

“Research has shown that abandoning the triple lock would reduce the chance that someone with low earnings retires with an adequate retirement income. The same older people who also stand to lose the most from any rise in the state pension age.”

However the triple lock should be abandoned in order to reduce the impact on future government finances, argued Mr Cridland, the former CBI director general who was appointed as the Government’s independent reviewer of state pension age last year,According to the review’s estimates, the UK – which currently spends £100bn a year on pensions – would spend the equivalent of 6.7 per cent of its GDP on the state pension in the 2066-67 financial year if it adopts the review’s age increase.

Abandoning the triple lock and just linking pension increases to earnings data would reduce this figure to an estimated 5.9 per cent of GDP.

Many pension experts broadly agreed with his recommendation. Former pension minister Baroness Altmann said there was “no economic or social rationale” for the triple lock, adding the 2.5 per cent increase was “not related to any economic variables and is politically motivated.”

“The longer the triple lock stays in place, the more disadvantaged those who are not covered will become and the greater the pressure to increase state pension age even further,” she said.

The government has promised to keep the triple lock in place until 2020, but has not revealed its intentions beyond that.Mr Cridland also recommended raising the state pension age to 68 between 2037 and 2039 – seven years earlier than currently planned.

His review coincided with an independent Government Actuary’s Department report, which pointed to a possible state pension age of 70 for anyone currently aged 30 or under.

And it’s not just retirees that are furious. Zlata Rodinova of the Independent reports, Millenials could have to wait until they are 70 until they get a state pension, says Government review:

Millions of young people could face having to work an extra year before being able to draw a state pension, according to two separate reports.

Under projections drawn up by the Government Actuary’s Department (GAD), people aged under 30, face working until the age of 70 to qualify for a state pension compared to the age of 68 under current legislation.

A separate official review published by John Cridland, former director-general of the Confederation of British Industry (CBI), proposed that state pension age should rise to from 67 to 68 between 2037 and 2039, seven years earlier than originally planned.

The current state pension age – the earliest age that a person can start receiving their state pension – is 63 for women and 65 for men. It is due to rise to 65 for both by late 2018, 66 by 2020, and 67 by 2028.

However, experts said if the new recommendations were adopted , people in their 40s would face their state pension age being pushed back by an extra year. They warned those in their 30s and younger may eventually face the possibility of having to wait until they are 70 before being able to draw their pension.

The Government is under pressure to address the spiralling cost of the £100bn-a-year state pension, which is expected to increased further as a result of rising life expectancy and therefore the increasing ratio of pensioners to workers.

In Thursday’s report, Mr Cridland said the change is necessary to keep the State Pension “fair and sustainable”.

“My review considers the consequences of an ageing society[…]. The aim is to smooth the transition for tomorrow’s pensioners, and to try and make the future both fair and sustainable.”

Vince Smith-Hughes, retirement expert at Prudential, said that as a result of the proposed changes younger people will need to plan ahead.

They are likely to find their state pension age is significantly higher than they currently assume,” he said.

Steven Cameron, pensions director at Aegon said requiring everyone to wait until an “ever increasing age” to draw a state pension is “inflexible and increasingly outdated”.

“This is a missed opportunity to meet the needs of those who through health concerns, job pressures or lack of employment opportunity simply can’t keep working into their late 60s. We call on the Government to keep the door open to future change,” Mr Cameron said.Prudential research earlier this week found that at least one in seven people retiring last this year made no financial provision for their retirement. The survey found that many rely heavily on the State Pension to provide an income when they stop working.

My advice to those thirty something workers in the UK and everywhere, start planning for your retirement early on so you can deal with unexpected policy shifts like this one where the state pension age is gradually pushed up and benefits are potentially cut.

Last week I discussed how collapsing US pensions might fuel the next crisis, beginning my analysis by noting the following:

“Please repeat after me: The global (not just American) pension crisis is deflationary because it exacerbates income inequality and will condemn hundreds of millions of workers to pension poverty.”

The thing to keep in mind is pensions are important, especially in an ageing population, because they allow people to live out their life after retiring on a modest fixed income. This means they can spend accordingly, allowing governments to collect more sales taxes and boosting overall economic activity in the process.

The UK is trying to slay its pension dragon and this fellow you see above, John Cridland, was appointed to review the pension system and recommended to raise the retirement age faster than previously recommended and to scrap the “triple lock” and link pensions to earnings.

If you ask my opinion, this is just more tinkering at the margins. The real fundamental problem with the UK state pension system is it’s grossly antiquated and needs a major overhaul to make it function more like the Canada Pension Plan – Canada Pension Plan Investment Board model.

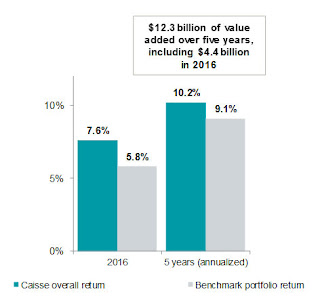

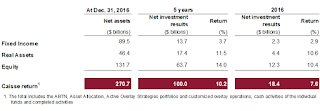

In fact, I recommend every country in the world adopts the governance that has allowed Canada’s large pensions to flourish while most of their global counterparts are witnessing their pension deficits skyrocket.

When I met Mark Machin, President and CEO of CPPIB, last fall, he told me flat out: “What Canada has achieved with the CPPIB is quite amazing, no other country in the world has this state pension system.”

And Machin is a UK citizen so he knows what he’s talking about. The model we have for our state pension in Canada is unique and we have a similar model for some some large provincial pensions (like the Caisse managing the assets of the Quebec Pension Plan).

There are other countries with great state pensions, like Denmark and the Netherlands, but very few can claim they have achieved a model based on what Canada has done with the CPP and CPPIB.

This is why I keep telling critics and skeptical Canadians to never bash the Canada Pension Plan and plans to enhance it. We Canadians don’t realize just how good we have it over the long run with this system.

As far as UK pension reform, it’s too late, all these measures to address the growing pension crisis in that country are doomed to fail. All of a sudden, the Brits are waking up to realize how unsustainable and poorly managed their state pension system truly is.

Look, fine, we can openly debate whether the state pension system is unsustainable and whether raising the retirement age makes sense since people are living longer, but at one point there needs to be a much more meaningful discussion on whether the system itself needs much deeper reforms to make it truly sustainable and equitable over the long run.

And it’s not like the UK pension system is terrible, it’s actually pretty decent, but it’s been slipping down the global pensions rankings in the last year, mostly owing to the fact that future retirees can expect a “less generous” income from state and workplace pensions.

I will end this comment with a true story from Greece. A few years ago, before the crisis hit, a friend of mine who is a doctor was swimming at the beach and noticed and elderly man who was in “phenomenal shape.”

My friend approached him and asked him how old he was, thinking the guy was around 65 years old. The elderly man told him he was 85 years old, which just floored my friend. He asked him how he has maintained his youth and strength.

The guy looked at my friend and told him flat out: “I retired at age 40 and never worked another day of my life.”

And then we wonder why the Greek pension system was unsustainable.

Why am I bringing this up? Because no matter where you live, there needs to be an honest, adult discussion on state and other public sector pensions to make sure they are sustainable and to avoid rampant abuses like the one I just mentioned above. And trust me, abuses happen everywhere, not just in Greece.

Update: Bernard Dussault, Canada’s former chief Actuary, shared these insights with me:

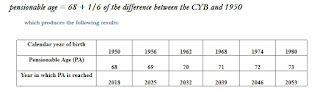

The UK government would save even more and would greatly improve inter-generational equity if in addition to increase the pensionable age by 1 from 67 to 68, it would afterwards pursue a permanent slow gradual increase based on the calendar of birth.

Indeed, as statistics generally show that longevity in the developed countries has on average steadily increased over the last few decades by about 2 months (i.e. any generation lives longer than the previous one, i.e. the higher the calendar year of birth, the higher the longevity at age 68) and is expected to pursue doing so, there is a case to keep increasing each coming calendar year the pensionable age by setting it as follows on the basis of the calendar year of birth (CYB, click on image):

I thank Bernard for sharing his thoughts with my readers.