Even smart people can disagree with each other. Who knew?

A great example of that sentiment is playing out right now, as a handful of nationally renowned retirement research groups have found each other at odds with the other’s conclusions about the retirement security of the next few waves of retirees.

Retirement savings (or a lack there-of) have been getting a lot of press lately. The Federal Reserve recently released data that suggested 20 percent of people aged 55-64 had zero money saved for retirement. All in all, 31 percent of people surveyed said they had no retirement savings at all.

Two other recent studies make similarly striking claims—a 2013 Pew Charitable Trusts study found that newer retirees would have far less income during retirement than their baby boomer predecessors. Likewise, a 2012 study by the Center for Retirement Research (CRR) found nearly half of households in their 50’s were “at risk” for a rocky retirement.

But the Employee Benefit Research Institute doesn’t think the situation is so dire. In fact, the EBRI has gone so far as to rebuff the findings of those latter two studies. From ThinkAdvisor:

EBRI recently challenged a pair of studies that concluded Gen Xers’ retirement prospects were in worse shape than boomers’ prospects, pointing out also that the oldest Gen Xers are only 49, with many earnings years left before they reach traditional retirement age.

EBRI charges that some studies used flawed assumptions or bad methodologies to reach their conclusion that investors born between 1965 and 1974 had a smaller likelihood of saving enough for retirement than older investors born between 1948 and 1964.

“Calculating retirement income adequacy is very complex, and it’s important to use reasonable assumptions and current data if you want credible results,” Jack VanDerhei, EBRI research director and author of the report, said in a statement.

More on the “flawed assumptions” used in the Pew and CRR studies:

EBRI took issue with a 2013 study by Pew Charitable Trusts that found the median replacement rate for Gen Xers who retire at 65 would be 32 percentage points lower than early boomers’ and nine points lower than later boomers’.

However, that finding “explicitly ignores future contributions,” EBRI argued. “EBRI’s analysis concludes that ignoring decades of potential future contributions (as the Pew study does) exaggerates the percentage of Gen X workers simulated to run short of money in retirement by roughly 10 to 12 percentage points among all but the lowest-income group,” according to the report.

An earlier study, conducted in 2012 by the Center for Retirement Research (CRR) at Boston College, found 44% of households in their 50s were “at risk,” compared with 55% of those in their 40s and 62% of those in their 30s.

In that report, CRR failed to consider the effect of automatic enrollment and escalation features, which were widely adopted following the Pension Protection Act of 2006. Gen X is the first generation to have a full working career in a defined contribution environment, EBRI noted.

EBRI says all its recent research points to very different conclusions than other studies: Generation Xers are facing approximately the same retirement prospects as the Boomers’.

EBRI concludes that 60 percent of Generation X won’t run out of money in retirement.

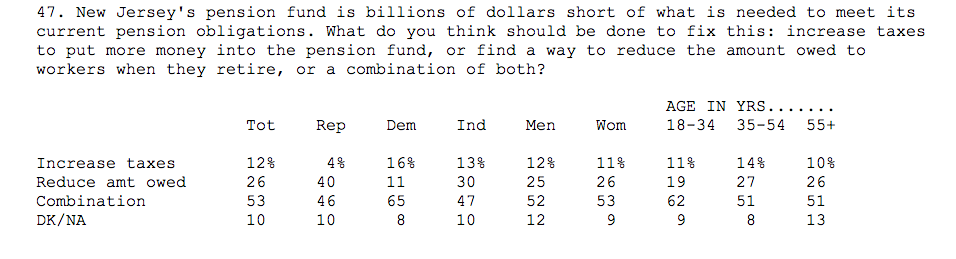

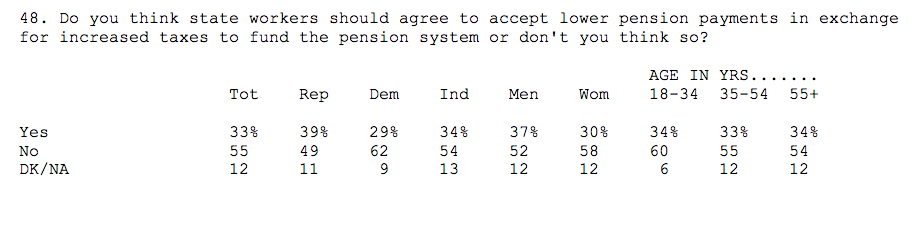

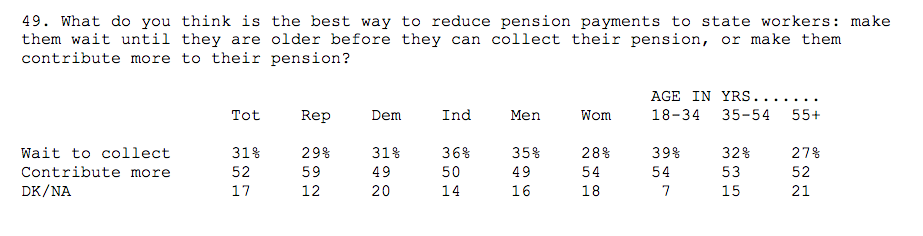

Finally, voters were asked which policy options they preferred to help fund the pension system. The options: increase taxes or reduce pension benefits.

Finally, voters were asked which policy options they preferred to help fund the pension system. The options: increase taxes or reduce pension benefits.