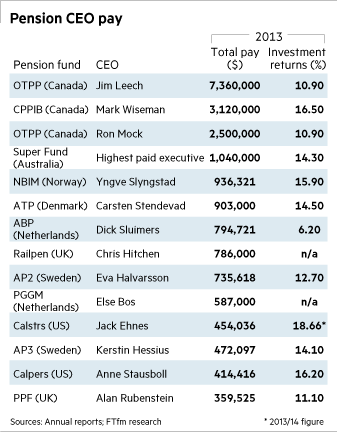

Canada Pension Plan Investment Board (CPPIB) Chief Executive Mark Wiseman sat down with Reuters for an interview last Friday, and made some interesting comments on how his fund deals with market volatility.

Wiseman said his fund would likely be particularly active in the coming months as fluctuations in commodities and currency markets open up investment opportunities.

Wiseman’s comments, from Reuters:

CPPIB, which manages Canada’s public pension fund, said that while investment deals have been slower in recent months because assets are fully valued, recent sharp movements in commodity and currency markets should help it find acquisitions.

“We are seeing more volatility in markets and that should generate more opportunities for CPPIB,” Chief Executive Mark Wiseman said in an interview.

“If you look at increased volatility, not just in equity markets but in currency markets, in commodity markets, the long-term view and those comparative advantages that we have, in these types of market conditions … our comparative advantages are more valuable,” he said, pointing to CPPIB’s scale, long investment horizon and certainty of assets.

[…]

Wiseman said that while CPPIB did not see deflation as a particularly large risk to the global economy, the world appeared to be moving to a two-speed model, with China and the United States showing growth and Europe and Japan needing “substantial long-term structural reforms” to improve.

“Let’s talk about Europe. It’s a very difficult situation. The economy has continued to underperform since the global financial crisis, and in terms of structural reforms, they have been reasonably slow in coming, for a myriad of reasons,” Wiseman said.

The CPPIB manages $191.3 billion in pension assets.

Photo credit: “Canada blank map” by Lokal_Profil image cut to remove USA by Paul Robinson – Vector map BlankMap-USA-states-Canada-provinces.svg.Modified by Lokal_Profil. Licensed under CC BY-SA 2.5 via Wikimedia Commons – http://commons.wikimedia.org/wiki/File:Canada_blank_map.svg#mediaviewer/File:Canada_blank_map.svg