Here’s a scenario to chew on:

An investment firm makes a campaign contribution to a city mayor. Later, the mayor appoints members to the city’s pension board. The pension board decides to hire the aforementioned investment firm to handle the pension fund’s investments.

Does something seem fishy about that situation?

The SEC says yes, and they have rules in place to prevent those “pay-to-play” scenarios.

But a recent lawsuit says no: investment managers should be able to donate money to whichever politicians they choose, even if those donations could present a conflict of interest down the line.

The lawsuit, filed last week by Republican committees from New York and Tennessee against the SEC, wants the court to affirm that political donations are free speech—and, by extension, current SEC pay-to-play rules are unconstitutional.

Under the SEC’s current rules, investment advisors can’t make donations to politicians that have any influence—direct or indirect—over the hiring of investment firms.

In many states, it’s the job of the governor or mayor to appoint members to the state or city’s pension board—the entity that controls pension funds’ investment decisions.

The lawsuit claims that it’s not fair to make investment firm employees choose between their career and their First Amendment rights.

But does the lawsuit have a shot?

If past court decisions are any indication, it certainly has a fighting chance. David Frum writes:

It’s a good guess that the federal courts will listen sympathetically to the challenge to the SEC rule. The Supreme Court has made clear that campaign contributions are protected free speech, both for individuals and for corporations. While protecting against corruption remains a valid basis for restricting contributions, the Court has defined corruption narrowly: In the words of the majority opinion in McCutcheon v. FEC, the most recent major campaign-finance case, corruption is “an effort to control the exercise of an officeholder’s official duties.” And as Justice John Roberts wrote in FEC v. Wisconsin Right to Life, the courts “must err on the side of protecting political speech rather than suppressing it.” It seems very conceivable that the courts will find the SEC rule overly broad.

It should be noted, the SEC didn’t put these rules in place for no reason.

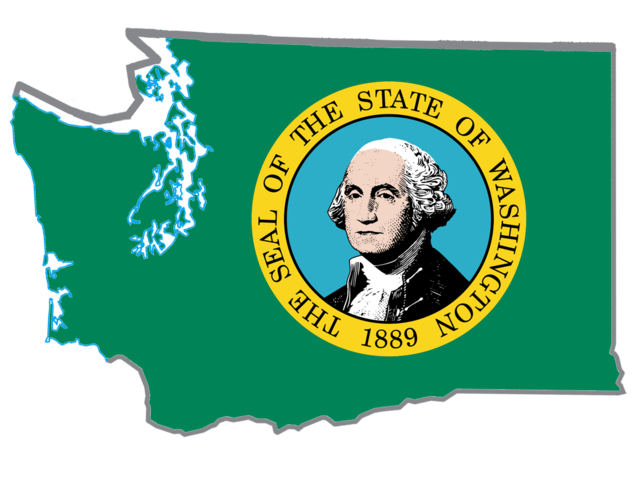

Over the course of a few years in the mid-2000’s, then-New York State Comptroller Alan Hevesi accepted over $1 million in campaign donations and gifts from investment firm Markstone Capital.

Hevesi, who at the time was the sole trustee of the New York State Common Retirement Fund, subsequently decided that the Fund should make a $250 million investment with Markstone.

Hevesi eventually pled guilty to corruption charges and served a little less than two years in prison. He is banned from holding public office again. The case was the catalyst for the pay-to-play rules the SEC currently has in place.

But Frum, in a piece written for the Atlantic today, wonders aloud whether the SEC rule targets the right people. Frum writes:

It’s a valid question whether the SEC rule is actually achieving anything.

The people with the most sway over state pension-funds decisions are not always—nor even often—elected officials. And those who exert the most effective influence over them are not always—nor even often—campaign contributors.

Frum points that it’s often placement agents who are helping to pull strings from behind the scenes. That’s been the case in California, Dallas, New Mexico and Kentucky, and those are just the high-profile ones.

From Frum:

In our belief that it’s politicians who are always and everywhere to blame for everything that goes wrong in a political system, we consign to the financial pages the abundant evidence that the most fundamental vulnerability of state pension plans to corrupt influence is located less in politicians’ need for campaign funds, and much more in the weak governance of state pension plans themselves.

As the New York Republicans’ case against the SEC winds its way through the courts, and if it begins to succeed, you’ll hear a lot of agitated discussion about what this all means for campaign finance, for Chris Christie, and for American elections. But the most important trouble—and the most disturbing practices—are located quite elsewhere. It will be worth keeping that in mind.

That doesn’t necessarily mean, however, that the SEC rule should be repealed and the floodgates opened.

It just means that the stuff happening behind closed doors—the opaque world of placement agents—is what we should be worried about, too.

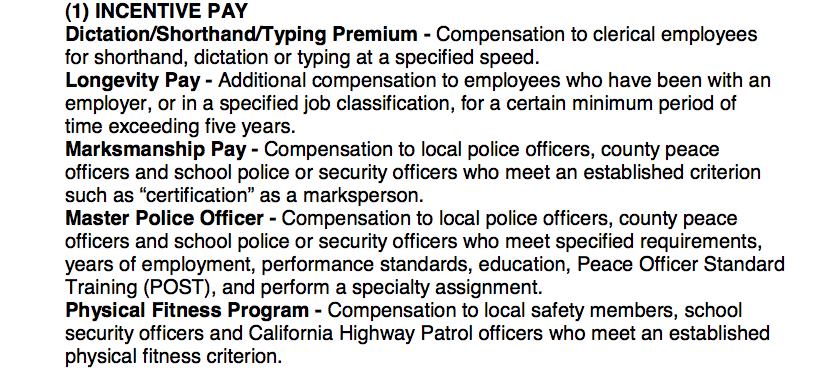

Here’s a summary of current pay-to-play regulation:

[iframe src=”<p style=” margin: 12px auto 6px auto; font-family: Helvetica,Arial,Sans-serif; font-style: normal; font-variant: normal; font-weight: normal; font-size: 14px; line-height: normal; font-size-adjust: none; font-stretch: normal; -x-system-font: none; display: block;”> <a title=”View Summary of the SEC&#x27;s Pay to Play Rule on Scribd” href=”http://www.scribd.com/doc/236911281/Summary-of-the-SEC-s-Pay-to-Play-Rule” style=”text-decoration: underline;” >Summary of the SEC&#x27;s Pay to Play Rule</a></p><iframe class=”scribd_iframe_embed” src=”//www.scribd.com/embeds/236911281/content?start_page=1&view_mode=scroll&show_recommendations=true” data-auto-height=”false” data-aspect-ratio=”undefined” scrolling=”no” id=”doc_2716″ width=”100%” height=”600″ frameborder=”0″></iframe>”]

Photo by Truthout.org via Flickr CC License