Back in November, Pension360 covered former San Jose Mayor Chuck Reed’s intention to keep pushing for pension reform even after leaving office.

According to a Reuters report, he’s following through: Reed, along with a coalition of business leaders and politicians, is launching a push to get a pension reform measure on the statewide ballot.

Details are sparse on what exactly the measure would look like.

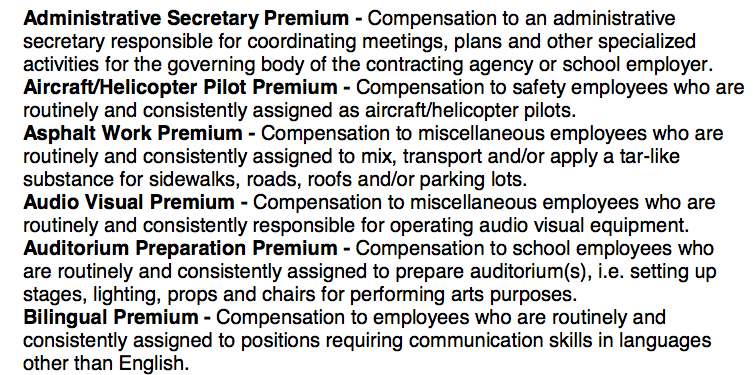

But it’s likely the measure would aim to make it easier for cities to cut pension payments to CalPERS, or reduce the cost of leaving the fund entirely.

More from Reuters:

The measure would take aim at California’s $300 billion giant Calpers, which has a near-iron grip on the state’s pensions. Calpers, America’s largest public pension fund and administrator of pensions for more than 3,000 state and local agencies, has long argued that pensions cannot be touched or renegotiated, even in bankruptcy.

“Calpers has dedicated itself to preserving the status quo and making it difficult for anybody to reform pensions,” Reed said in an interview. “This is one way to take on Calpers, and yes, Calpers will push back.”

Calpers spokeswoman Rosanna Westmoreland said: “Pensions are an integral part of deferred compensation for public employees and a valuable recruitment and retention tool for employers.”

[…]

To win a place on the 2016 ballot, backers of the initiative will have to obtain the signatures of 585,000 registered voters, or 8 percent of the number of voters in California’s last gubernatorial election, in this case 2014.

Reed and his allies have been huddling with legal advisers for months to devise a voter initiative that is simpler and less vulnerable to court challenges than last year’s effort.

Reed’s goal is for the measure to appear on the November 2016 ballot.

Photo by San Jose Rotary via Flickr CC License