The numbers are in for the Canada Pension Plan’s investment performance over the first quarter of fiscal year 2015, and the country’s largest pension fund probably isn’t thrilled with the results.

The CPP returned 1.6 percent over the three month period ended June 30. Far from disastrous, the performance still falls short of its peers: the median return of Canadian pension funds over the same period was 3 percent.

In a statement, Canada Pension Chief Executive Mark Wiseman said: “All of our programs reported positive investment returns during the quarter and we continued to further diversify the portfolio globally across various asset classes.”

To that end, the Canada Pension Plan’s Investment Board also announced today that it will be allocating an additional $500 million to investments in the U.S. industrial sector.

Specifically, the investments are in warehouse facilities in high-demand areas of California that will subsequently be leased out. From a CPP press release:

The six logistics and warehouse developments GNAP has committed to are:

- GLC Oakland – 375,000-square-foot Class-A warehouse distribution facility recently completed in Oakland, California, adjacent to the Oakland International Airport.

- GLC Rancho Cucamonga – two warehouse distribution facilities totaling up to 1.6 million square feet in Rancho Cucamonga, California, 40 miles west of Los Angeles, in the Inland Empire West submarket.

- Commerce Center Eastvale – three logistics warehouses providing in excess of 2.5 million square feet located in Eastvale, California, 50 miles west of Los Angeles, in the Inland Empire West submarket.

- GLC Fontana – 640,000-square-foot warehouse distribution facility located in Fontana, California, 50 miles west of Los Angeles, in the Inland Empire West submarket.

- GLC Compton – 100,000-square-foot distribution facility in Compton, California, a prime infill location within the South Bay submarket of Los Angeles.

-

GLC Santa Fe Springs – three warehouse distribution facilities totalling up to 1.2 million square feet located in Santa Fe Springs, California, a prime infill location within the Mid-Counties submarket in Los Angeles.

The CPP already had allocated $400 million to the Goodman North American Partnership (GNAP), a joint venture formed between the CPP Investment Board and Goodman Group.

Photo: “Canada blank map” by Lokal_Profil. Licensed under Creative Commons Attribution-Share Alike 2.5 via Wikimedia Commons

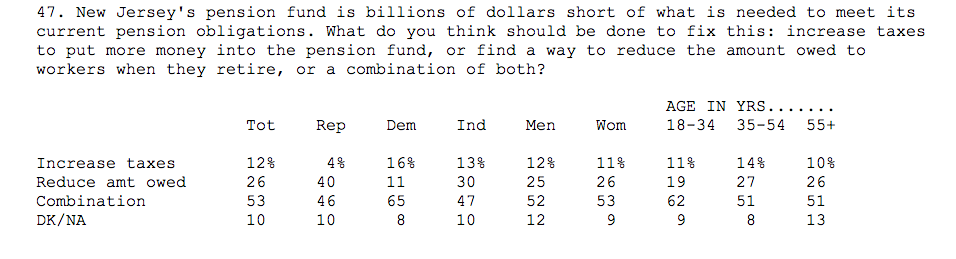

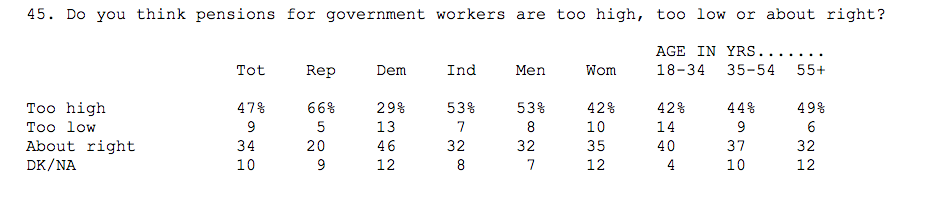

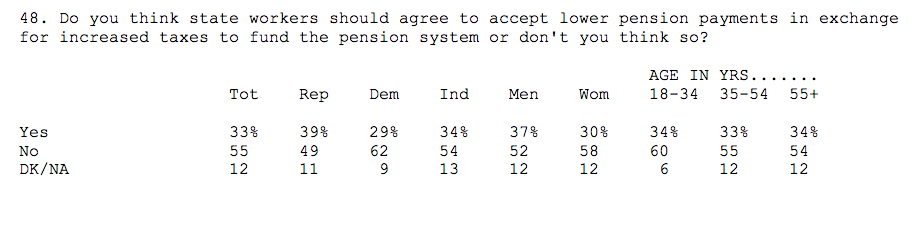

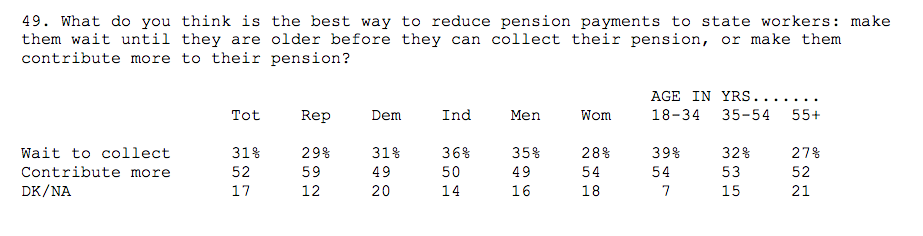

Finally, voters were asked which policy options they preferred to help fund the pension system. The options: increase taxes or reduce pension benefits.

Finally, voters were asked which policy options they preferred to help fund the pension system. The options: increase taxes or reduce pension benefits.