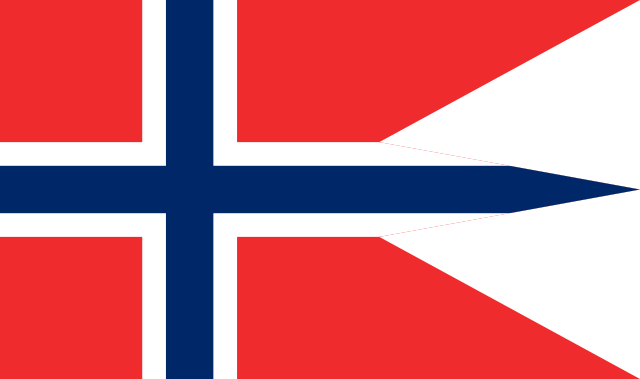

Norway’s Giant Fund Buckles in Q2?

Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse. Camilla Knudsen of Reuters reports, Norway’s $870 bln fund sinks to first loss in three years: Norway’s $870 billion sovereign wealth fund reported its first quarterly loss in three years on Wednesday, hauled down by … Continue reading Norway’s Giant Fund Buckles in Q2?