A long, insightful discussion and analysis of pension design was published in the Fall issue of the Rotman International Journal of Pension Management. During the course of the paper the three authors, Thomas van Galen, Theo Kocken, and Stefan Lundbergh, propose a set of principles to help navigate the dilemmas and trade-offs posed by both public and private pension systems.

The paper begins:

Designing a pension system is a complex business in which difficult tradeoffs must be made. On the one hand, we may want everyone to receive a retirement income that is linked to their own contribution; on the other, we want to protect people from poverty. How do we weight these two goals? The choice will depend on societal preferences and cultural values. We must also ask for whom we should design the pension system: what is ideal for a self-employed high-income earner may be far from adequate for someone living on a minimum wage, paying rent, and raising a family of five.

Addressing these dilemmas is a daunting task, especially with the recognition that pension systems all have their own historical background, and that each has evolved in its own particular context.

The authors propose a set of pension design principles, organized into three groups: behavioral principles, stability principles and risk-sharing principles.

The behavioral principles:

1. Keep it simple. Don’t make the pension solution any more complex than necessary. Complexity and lack of transparency make decision making more difficult, increasing the risk that people will make decision they will later regret. Simplicity, by contrast, helps manage people’s expectations and increases their trust, both vital qualities for a successful pension system.

2. Provide sensible choices. Employees should be given a standard package, on top of which a limited set of well- considered alternatives are offered, to protect them from making mistakes while allowing them individual freedom (Boon and Nijboer 2012). Creating a set of choices for a pension system is like drawing up a good restaurant menu: it offers people tools (the menu) for tailoring the solution (the meal) to their needs, but without expecting them to be financial experts (the chef) (Thaler and Benartzi 2004).

3. Under-promise, over-deliver. Research has shown that people experience twice as much pain from a loss as pleasure from a gain of equal size. Therefore, it is wise to avoid delivering outcomes below people’s expectations, which implies that a pension system should offer people a minimum level of pension income that, in practice, will likely be exceeded (Tversky and Kahneman 1992). Research shows that people value some kind of certainty very highly and are willing to pay substantial sums of money for it (Van Els et al. 2004), but too much certainty will make the pension design unaffordable.

The stability principles:

1. Ensure adaptability. Constantly changing external conditions require an adaptable pension system. Explicit individual ownership rights ensure flexibility, so that the system can adjust itself over time, and also make pensions more mobile to move to other systems.

2. Keep it objective. The health of a pension system should be measured based on objective market valuations. An objective diagnosis ensures that beneficiaries feel comfortable with how the pension fund deals with their property rights. If the valuations are calculated differently from market practice, participants may feel they are better off outside the system.

3. Prepare for extreme weather. The world is uncertain and unpredictable things happen; a pension system should be robust under extreme circumstances, built not on predictions but on consequences of possible outcomes. To assess the system’s robustness, draw up a set of “extreme weather” scenarios for risks outside and inside the pension system. The design of the pension system should target the ability to endure these extreme scenarios.

And the risk-sharing principles:

1. Avoid winner/loser outcomes. To avoid losing support, pension system design should prevent any one group of participants benefitting at the cost of another group. For example, if internal pricing in DB plans deviates from market pricing, it is likely to create winner/loser outcomes, eventually leading to pension system distrust.

2. Only diversifiable risks should be shared. A system founded on solidarity in bearing diversifiable risk creates value for all by reducing individual risk. For example, we have no idea how long we will live after we retire, but we can estimate the current average life expectancy of a homogenous group reasonably well, so it makes sense for individuals to pool their individual longevity risk with a large group.

3. Individuals must bear some risks. Risks that cannot be diversified or hedged in the market should be borne by the individual. Pooling non-diversifiable risks leads inevitably to transfers between groups in the collective pool and will eventually erode trust in the system. In reaching for higher long-term returns, younger people can absorb more market risk than older people; this calls not for risk sharing but for age differentiation in exposure to financial markets.

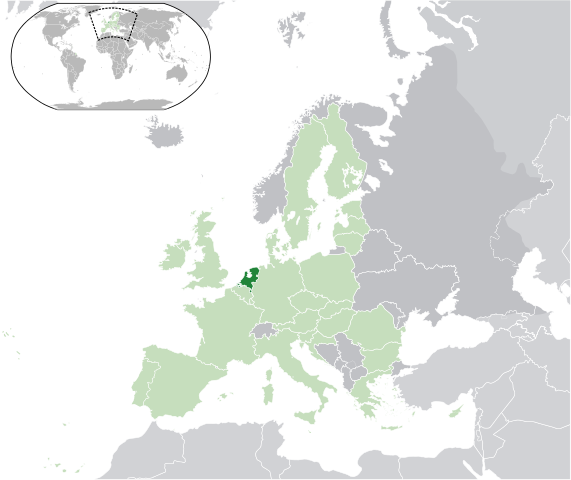

The authors go on to provide examples of these principles in action, using pension systems from the UK, Sweden and the Netherlands. The full seven page paper can be read here.