Pension fund officials from Canada and the Netherlands expressed their frustration with private equity fees during a conference this week.

The chief investment officer of the Netherlands’ $220 billion healthcare pension fund said it needs “to think about” the fees it is paying, according to the Wall Street Journal.

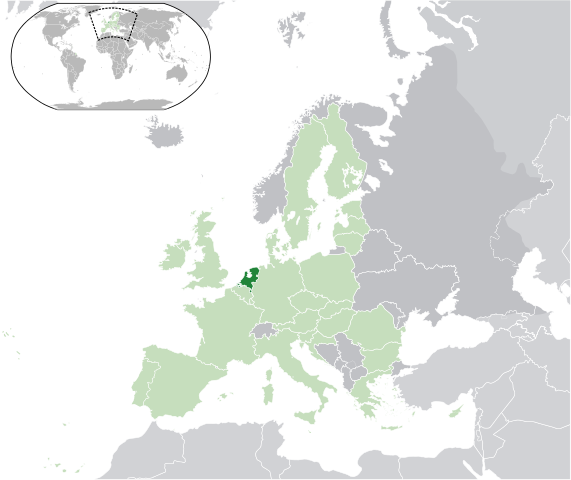

Ruulke Bagijn, chief investment officer for private markets at Dutch pension manager PGGM, said a Dutch pension fund for nurses and social workers that she invests for, paid more than 400 million euros ($501.6 million) to private-equity firms in 2013. The amount accounted for half the fees paid by the PFZW pension fund, even though private-equity firms managed just 6% of its assets last year, she said.

“That is something we have to think about,” Ms. Bagijn said.

Among the things pension officials are thinking about: bypassing private equity firms and fees by investing directly in companies. From the Wall Street Journal:

Jane Rowe, the head of private equity at Ontario Teachers’ Pension Plan, is buying more companies directly rather than just through private-equity funds. Ms. Rowe told executives gathered in a hotel near Place Vendome in central Paris that she is motivated to make money to improve the retirement security of Canadian teachers rather than simply for herself and her partners.

“You’re not doing it to make the senior managing partner of a private-equity fund $200 million more this year,” she said, as she sat alongside Ms. Ruulke of the Netherlands and Derek Murphy of PSP Investments, which manages pensions for Canadian soldiers. “You’re making it for the teachers of Ontario. You know, Derek’s making it for the armed forces of Canada. Ruulke’s doing it for the social fabric of the Netherlands. These are very nice missions to have in life.”

But an investment firm executive pointed out that direct investing isn’t as cost-free as it sounds. From the WSJ:

[Carlyle Group co-founder David Rubenstein] warned that investors who do more acquisitions themselves rather than through private-equity funds will have to pay big salaries to hire and retain talented deal makers.

“Some public pension funds will just not pay, in the United States particularly, very high salaries and will not be able to hold on to people very long and get the most talented people,” Mr. Rubenstein said at the conference. “I don’t think there are that many people who will pay their employees at these sovereign-wealth funds and other pension funds the kind of compensation necessary to hold on to these people and get them.”

[…]

Mr. Rubenstein had a further warning for investors seeking to compete for deals with private-equity firms. “If you live by the sword you die by the sword,” he said. “If you are going to do disintermediation you can’t blame somebody else if something goes wrong.”

Pension360 has previously covered how pension funds are bypassing PE firms and investing directly in companies. One such fund is the Ontario Municipal Employees Retirement System. The fund’s Euporean head of Private Equity said last month:

“The amount of fees that we were paying out for a fund, 2 and 20 [percentage points] and everything that goes with that, was a huge amount of value that we were losing to the fund,” Mr. Redman said. “If we could deliver top quartile returns and we weren’t hemorrhaging quite so much in terms of fees and carry that would mean that we would be able to meet the pension promise.”

Photo by http://401kcalculator.org via Flickr CC License