For CalPERS, the empty lot that currently sits at Third and Capitol in downtown Sacramento represents both a past failure and future opportunity.

CalPERS owns the lot, which has sat vacant since the fund lost $60 million on a failed condo development there in 2007.

That’s why CalPERS is being cautious with plans to develop the lot, even if it’s a hot property with the new Sacramento Kings arena being built just a few blocks away.

From the Sacramento Bee:

CalPERS has become more conservative about developing property from the ground up and now says it will take its time before proceeding at the downtown site.

“We plan to be very smart before jumping back into construction,” said Ted Eliopoulos, the newly installed chief investment officer at the California Public Employees’ Retirement System.

That’s not to say the nation’s largest public pension fund is ignoring the site’s potential. With the Kings’ arena set for an October 2016 opening and the downtown market in a state of revival, Eliopoulos said CalPERS and its development partner, CIM Group of Los Angeles, are committed to eventually doing something big at Third and Capitol.

“It deserves a project of scale, an iconic project,” said Eliopoulos, the man who pulled the plug on the original condo and hotel towers in 2007 after construction had begun.

In the most extensive comments the pension fund has made about the site in years, Eliopoulos said CalPERS and CIM are trying to determine “what mix of office, apartment, retail would be most appropriate for the site, from an economic standpoint, from a community standpoint.”

More details on the failed condo development that was originally supposed to occupy the space:

For the past seven years…Third and Capitol has been a humbling reminder, for both CalPERS and the city, of the collapse of the real estate market.

With CalPERS as his major financial backer, Sacramento developer John Saca was going to build twin 53-story condo and hotel towers on the site that once housed the old Sacramento Union newspaper. Along with the Aura condo project proposed a few blocks east, the Saca Towers were going to launch a downtown housing boom.

Neither project materialized, but the Saca project was the more spectacular failure. The fenced-off site, now a ghost town of weeds, trees and concrete pilings, has become known in some quarters as “the hole in the ground.”

Billed as the tallest residential project on the West Coast, the towers got off to a surprisingly strong start.

[…]

Eventually, though, the project ran into big problems – namely, $70 million worth of cost overruns caused by troubles with the concrete pilings. After spending $25 million, CalPERS cut off funding in January 2007. The decision was made by Eliopoulos, a private developer who had just joined CalPERS as senior investment officer for real estate.

“That was my first week on the job,” Eliopoulos said. “That was the first decision that I made, to stop the project.”

Months of public wrangling ensued between the two partners, with Saca complaining that he’d been undermined by CalPERS. Eventually, the pension fund got control of the site, but at a cost. On top of the original $25 million, it spent an additional $35 million to satisfy contractors’ liens, repay a mortgage and perform some additional pre-construction work. (The customers’ deposits, parked in an escrow account, were also returned.) CIM Group, which has built several downtown Sacramento buildings and partnered with CalPERS on the Plaza Lofts project on J Street years ago, was brought in to manage the forlorn site and advise the pension fund on possible uses.

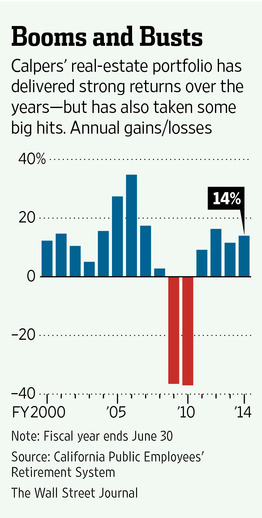

CalPERS lost $10 billion on real estate investments between 2008 and 2010. In the years since, its real estate portfolio has seen double-digit returns almost every year.

The fund plans to increase its real estate holdings by 27 percent by 2016.

Photo by Photo by Stephen Curtin