CalPERS is drafting new regulation that could boost worker pensions, but critics say the rules would fly in the face of much of Gov. Jerry Brown’s 2012 reform efforts. CalPERS is holding a public hearing on the issue tomorrow (Tuesday August 19) to seek the public’s feedback.

The new regulations could increase pension benefits for many workers by adding 98 new types of “pensionable compensation”—or, in other words, types of pay that can be counted toward pension benefits.

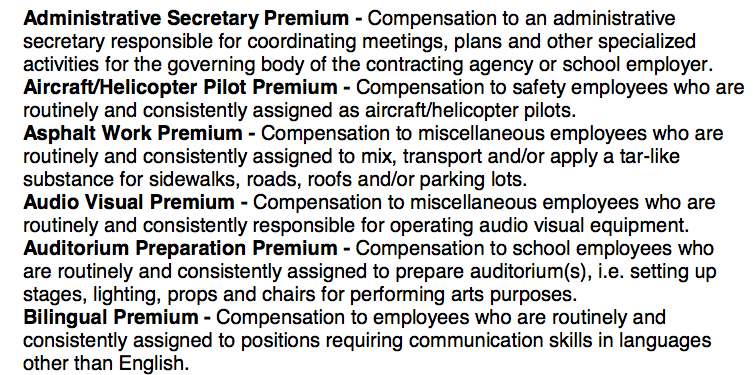

For example, workers would receive pension boosts for holding various professional certifications, for being bilingual or for working at the same job for a long period of time.

[Read the full list of types of pensionable compensation at the bottom of this post].

From a CalPERS press release:

The proposed new regulation is intended to clarify the types of pensionable compensation items that state, public agencies, and school employers report to CalPERS as part of a new member’s retirement benefit. The most common items excluded as pensionable for new PEPRA members are bonuses, uniform allowance, and any ad hoc payments. Members who were hired on or after January 1, 2013 are considered new members under PEPRA.

Compensation that is reportable for classic members is unaffected under the new regulation.

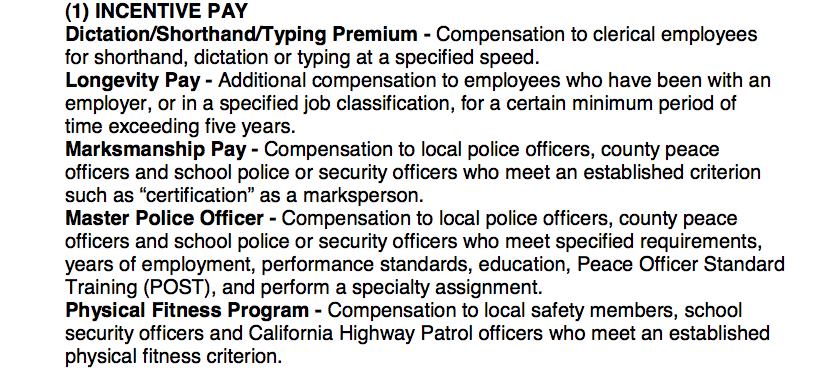

One category of pensionable compensation would be Incentive Pay.

A few other interesting special pay items:

As the CalPERS released indicates, these changes would only apply to new hires. But critics say the new rules would directly undermine California 2012 pension reforms, which also only dealt with new hires. From a LA Daily News editorial:

At issue is what counts as income on which pensions are calculated. The 2012 law was clear: Pensions for new employees should be based on their “normal monthly rate of pay or base pay.” Whereas current employees can boost their pension calculations by also including “special compensation” for “special skills, knowledge, abilities, work assignment, workdays or hours, or other work conditions,” the Legislature didn’t include those sorts of extra pay items for new employees.

The hearing over the draft regulations will be held on Tuesday at 9:30 am pacific time.

It will also be live-streamed at www.calpers.ca.gov.

[iframe src=”<p style=” margin: 12px auto 6px auto; font-family: Helvetica,Arial,Sans-serif; font-style: normal; font-variant: normal; font-weight: normal; font-size: 14px; line-height: normal; font-size-adjust: none; font-stretch: normal; -x-system-font: none; display: block;”> <a title=”View Proposed Adoption Pensionable Compensation on Scribd” href=”http://www.scribd.com/doc/237135073/Proposed-Adoption-Pensionable-Compensation” style=”text-decoration: underline;” >Proposed Adoption Pensionable Compensation</a></p><iframe class=”scribd_iframe_embed” src=”//www.scribd.com/embeds/237135073/content?start_page=1&view_mode=scroll&show_recommendations=true” data-auto-height=”false” data-aspect-ratio=”undefined” scrolling=”no” id=”doc_62392″ width=”100%” height=”600″ frameborder=”0″></iframe>”]