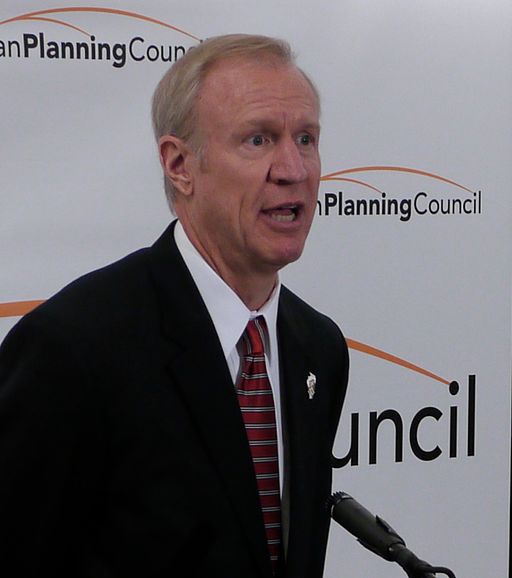

Over the course of his campaign, Illinois governor-elect Bruce Rauner accepted contributions from executives from firms that manage portions of the state’s pension money, according to a new report from David Sirota.

Those contributions may violate SEC pay-to-play rules, under which investment firms can’t make donations to politicians that have any influence—direct or indirect—over the hiring of firms to handle pension investments.

As Illinois governor, Rauner will have that influence – the governor has the power to appoint trustees to the state’s pension boards.

More from David Sirota on the donations:

During his gubernatorial campaign, Rauner raised millions of dollars from executives in the financial sector — and, despite the pay-to-play rule, some of the money came from executives at firms affiliated with funds that receive state pension investments. That includes:

– $1,000 from Mesirow Financial senior managing director Mark Kmety and $2,000 from Mesirow Financial managing director David Wanger. ISBI’s 2013 annual report lists Mesirow Financial as a hedge fund-of-fund manager for the pension system, and lists $271 million in holdings in Mesirow investment vehicles. In an emailed statement, a Mesirow spokeswoman told IBTimes that a separate branch of Mesirow works with the Illinois pension system and that therefore “we do not believe these contributions violate the pay to play laws.” Neither Rauner donor from Mesirow Financial “has any relationship with and/or receives any compensation from any state entity, nor do they pursue state business,” she wrote.

– $2,500 from Sofinnova general partner James Healy. TRS lists Sofinnova as a private equity manager. The system’s 2013 annual report says the firm manages $8.1 million of state pension money, and was paid more than $900,000 in fees that year. In June, TRS committed to invest another $50 million of state pension cash in Sofinnova. Healy did not respond to IBTimes’ interview request.

– $5,000 from Northern Trust’s Senior Vice President Brayton Alley. Illinois TRS lists Northern Trust Investments as an equity manager. The system’s 2013 annual report says Northern Trust manages $2.3 billion of state money, and made $548,000 in fees from the system that year. A spokesman for the firm told IBTimes, “We are aware of the obligations under various Illinois and federal laws and regulations” and “we are unaware of any violation to such requirements.”

– $9,600 from employees of the real estate firm CBRE. The 2013 annual reports of TRS and ISBI show a combined $184 million worth of state pension investments in CBRE investment vehicles. A representative for CBRE told IBTimes that the employees are not covered by the SEC rule because they are not involved in state pension business and not employed by the subsidiary of CBRE that does pension investment work.

– More than $90,000 in in-kind contributions from John Buck of the John Buck Company, which is listed as an investment manager for TRS. A spokesman for TRS, David Urbanek, told IBTimes that the pension system’s investment in the John Buck Company “is now in wind-down mode” and added that “the company is no longer actively managing TRS money.” A representative for the John Buck company said, “We do not manage money for TRS.”

While some of the contributions are relatively small, the SEC recently prosecuted its first pay-to-play case over donations totaling just $4,500. SEC sanctions can be strong: The rule can compel investment managers to return all fees they have collected from the pension systems after the political contributions were made.

Illinois state law also restricts contributions from state contractors to candidates for governor, though the executive director of ISBI, William Atwood, told IBTimes that the pension systems are exempt from the statute.

Specifics of the SEC rule in question, as explained by law firm Bracewell & Giuliani:

Rule 206 (4)-5, which was adopted in 2010, prohibits investment advisers from providing compensatory advisory services to a government client for a period of two years following a campaign contribution from the firm, or from defined investment advisers, to any government officials, or political candidates in a position to influence the selection or retention of advisers to manage public pension funds or other government client assets. Some de minimus contributions are permitted, topping out at $350 if the contributor is eligible to vote for the candidate, and the contribution is from the person’s personal funds.

Read Sirota’s entire report here.

By Steven Vance [CC-BY-2.0 (http://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons