As more pension funds participate in direct investing or co-investing ventures, they find the need for private equity experts on their staff.

As more pension funds participate in direct investing or co-investing ventures, they find the need for private equity experts on their staff.

But the cost of getting that talent is growing: a recent survey found that almost 50 percent of pension funds are having to shovel out higher salaries to recruit and retain private equity employees.

From the Financial Times:

Private equity employees are commanding higher wages as increasing amounts of money are pushed into the asset class.

Almost half of North American limited partnerships (pension funds and funds of funds) are having to increase their pay scales to recruit staff, according to a survey of 114 investors and private equity funds by Coller Capital, which invests in the secondary private equity market. The European market lags behind somewhat, with 30 per cent of LPs increasing salaries.

“The industry has done very well over the past couple of years, with very strong distribution,” said Michael Schad, a partner at Coller Capital. “As there is more demand from employers, wages can go up.”

As well as the industry expanding, investors are entering more directly into the asset class, either co-investing with general partners or building their own private equity investment capabilities. “This requires different skill sets,” said Mr Schad.

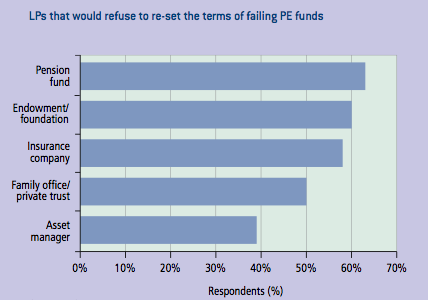

The survey also asked where funds were looking to recruit PE employees:

While more than half expect to recruit employees from other LPs, almost as many (46 per cent) will look for talent at alternative asset managers that are not private equity firms. A third will take on former investment bankers, but just a quarter hope to attract workers from general partners (private equity firms).

Increasing remuneration may be good news for the LPs, according to remarks made by Klaus Ruhne, partner at ATP Private Equity Partners, during a round-table held by private equity consultant Triago in November.

“What is more important than the size of teams, or the value of assets under management, is the frequent lack of generous long-term incentive plans for limited partners,” he said. “Without a restructuring of LP compensation, we will continue to witness an inordinate amount of inconsistency and even foolishness when it comes to how capital is deployed and how limited partners are organised.”

The survey was conducted by Coller Capital.

Photo by 401kcalculator.org