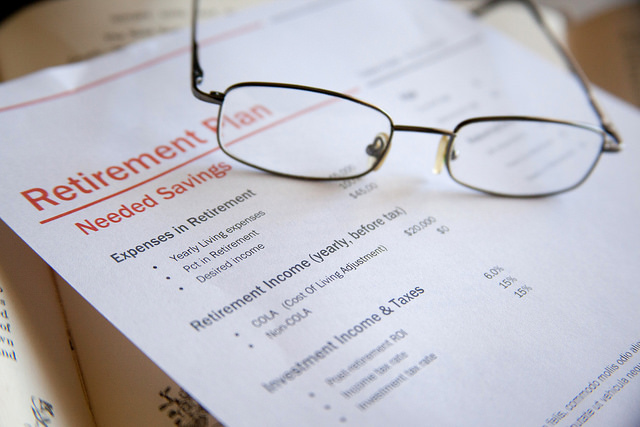

Retirement plan designers often encounter ethical dilemmas over the course of their careers.

A recent paper in the Journal of Pension Benefits, authored by Kelly Marie Hurd, dives into some ethical scenarios that might be presented to plan consultants.

First: Clients need to know the regulations surrounding the plan – even if they don’t necessarily want to hear them:

To a client, the laws and regulations can feel like a foreign language at best or at worst can seem like a hindrance. However, they also can be an excellent safety net to help clients understand the importance of avoiding discrimination issues. The various tests that must be performed each year help keep the plan on the right path, and taking the time to explain those requirements, at least in a general way, during the implementation stage can go a long way to ensuring that your client has a basic understanding of what is and what is not permissible.

It’s also important the plan consultant untangle the web of competing interests being brought to the table:

Different types of retirement plan professionals bring different perspectives to the plan design process, perspectives that may be complementary or competing…

An investment advisor may be primarily concerned with enrollment and access for employees to boost participation in the plan, as well as maintaining relationships with the participants to help them meet their financial goals. While all of these are reasonable perspectives, they also may lead to differences of opinion when it comes to plan design. For example, the investment advisor may want to push auto-enrollment, while the TPA has concerns about the possibility for missed enrollments that would then lead to potentially costly corrections. Rather than competing over such questions, the investment advisor and TPA should work collaboratively to communicate the pros and cons of the different design options to arrive at the design that is best for the client to target benefits, expand participation, etc., while ensuring that the client has a compliant and qualified plan.

Finally, the author presents this scenario:

There are many times you wish you could explain something to your client about how the plan works in simple language, but the solution leads you into an area where you are explaining discrimination to your client in a way that might influence his or her hiring practices. I have a client, a professional office, where the owner employs three staff members. The owner is nearing retirement and hoping to put away the maximum amount each year, although he does not draw a large salary. The plan is a cross-tested plan, which means that to get to a 70 percent coverage level, all three of the staff members need to benefit at the same percentage as the owner. And in this company, the office manager is only a few years younger than the owner.

It seems like such an easy suggestion to tell the client to hire a part-time college-age worker and make him or her eligible for the plan, but at the end of the day that is a potentially abusive manipulation of both the retirement plan regulations and age discrimination laws. Rather than suggest demographic changes, I revisit the plan design each year to see if there is a better option based on the existing demographics. There may not always be a cookie-cutter solution, but it is our illustrious burden to continue to strive for that perfection.

To read the entire paper, titled “The Ethics of Plan Design”, click here [subscription required].

Photo by Stephen Wu via Flickr CC License