There were big headlines earlier this month when CalPERS announced its decision to chop its hedge fund allocation by 40 percent. The news was big not just because it was CalPERS, but because the decision followed in the wake of similar decisions made by smaller funds around the country.

The Los Angeles Fire & Police Pension System might not be a mammoth like CalPERS, but it was still a big deal when the $18 billion fund decided to phase out hedge funds entirely. The fund says it will save around $13 million in fees annually as a result of the decision, which re-allocated $550 million from hedge funds into other asset classes.

“We need to show that we are willing to walk away from managers that are charging us exorbitant fees,” Emanuel Pleitez said in a video interview with Pensions & Investments.

But it’s not just fees. Past experiences inform future investments, so when the Louisiana Firefighters Pension Fund drastically chopped its hedge fund allocation, it was hard to blame them.

That’s because the Firefighters Fund in 2008 had made a $15 million investment in Fletcher International Ltd, a Cayman Islands-based hedge fund.

Sometime in 2012, Fletcher stopped picking up their phone. The Firefighters later found out that was because Fletcher had gone bankrupt. Just like that, they’d lost 100 percent of their $15 million investment.

As a result, the Firefighters Fund reduced its hedge fund investments by nearly 90 percent. Now, only 0.6 percent of the fund’s assets are dedicated to hedge funds, according to Pensions & Investments.

Anecdotal evidence aside, there’s very little indication the movement away from hedge funds is a larger trend.

In fact, if there is a trend, it may be moving towards more hedge fund investments, not fewer. Sticking with anecdotes for a moment, Pensions & Investments reports that a handful full of pension funds are looking to make their first foray into hedge funds:

Among recent first-time hedge fund investors and searchers:

-Illinois State Universities Retirement System, Champaign, will soon begin a search for either hedge fund or fund-of-funds managers for a new 5% allocation for the $16.9 billion defined benefit plan it oversees;

-The $5.1 billion City of Milwaukee Employes’ Retirement System hired Allianz Global Investors to manage $62.5 million in an absolute-return strategy in July;

-The $1.1 billion St. Paul (Minn.) Teachers’ Retirement Fund Association hired EnTrust Capital Management LP to manage $55 million in a customized hedge fund-of-funds separate account in May.

A recent survey revealed that institutional investors are planning on increasing their alternative allocations by 5 percent annually, as opposed to 1 or 2 percent for traditional investments.

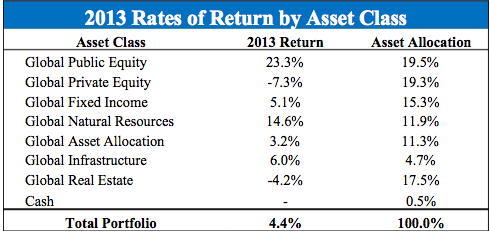

McKinsey, the firm behind the survey, said the prevailing sentiment among respondents was that the bull market won’t last forever. But pension funds’ assumed annual rates of return—which usually sit between 7 and 8 percent—won’t change anytime soon.

It’s for precisely that reason that institutional investors are turning to hedge funds, writes McKinsey & Co:

“With many defined-benefit pension plans assuming, for actuarial and financial reporting purposes, rates of return in the range of 7 to 8% — well above actual return expectations for a typical portfolio of traditional equity and fixed-income assets — plan sponsors are being forced to place their faith in higher-yielding alternatives.”

That doesn’t necessarily translate to investing with hedge funds. But often, it does.

And it’s not just about chasing high returns, the report said:

“Gone are the days when the primary attraction of hedge funds was the prospect of high-octane performance, often achieved through concentrated, high-stakes investments. Shaken by the global financial crisis and the extended period of market volatility and macroeconomic uncertainty that followed, investors are now seeking consistent, risk-adjusted returns that are uncorrelated to the market.”

Only time, and piles of financial reports, will reveal which direction the trend ultimately goes.