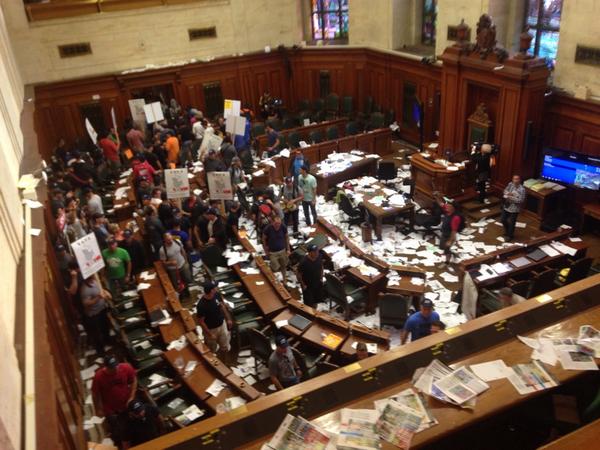

Dozens of municipal workers in Montreal are facing criminal charges after participating in a protest that left the city hall in shambles.

The protest stems from a proposed law, Bill 3, which would force workers to pay more into the pension system to cover funding shortfalls. From the Canadian Press:

Montreal’s police chief says 44 people will face criminal charges in connection with a rowdy pension protest inside city hall earlier this month.

Marc Parent says the charges will include participating in an illegal gathering, mischief and assault.

Around 250 unionized municipal workers stormed into city hall on Aug. 18, where they tossed paper all over the main chamber and plastered the building with protest stickers.

The demonstrators also unfurled a sign calling the mayor a thief, while one councilor alleges he was struck while others said they were sprayed with water.

More details on the controversial Bill 3, from the Montreal Gazzette:

Here is what Bill 3 would do:

— Ensure that as of Jan. 1, 2014, all municipal employees would, retroactively, begin to contribute half the cost of their pensions, while municipalities pay the other half. (Some unions have negotiated better pension deals, where the employer pays 70 per cent and the employee pays 30 per cent, for example);

— Ensure that employees and municipalities share the cost evenly of any pension plan deficits accumulated before Jan. 1, 2014;

— Forbid pension plan costs from exceeding 18 per cent of payroll costs;

— Allow cities to freeze cost-of-living increases in pension payouts to municipal retirees;

— Allow the province to appoint an arbitrator who could impose a settlement if negotiations fail to result in an agreement within 18 months. The arbitrator would then have an additional six months to impose a settlement.