When Pension360 last reported on news out of Pennsylvania, its governor was refusing to sign the state’s budget by the July 1st deadline unless lawmakers passed major pension reform.

The July 1st deadline has come and gone, and no reform measures have emerged from the legislature. But Gov. Tom Corbett made his move yesterday—signing the budget but forcefully wielding his line item veto power. The strategy: cut vital spending from the budget in an attempt draw lawmakers away from their summer vacations and back to the capitol:

Overall, Corbett struck $65 million from the Legislature’s own appropriations and another $7.2 million in earmarks and other spending items picked by lawmakers, noting that the proposal sent to him last week increased the General Assembly’s own $320 million budget by 2 percent.

“They filled the budget with discretionary spending and then refused to deal with the biggest fiscal challenge facing Pennsylvania, our unsustainable public pension system,” Corbett told reporters.

Overall, the $29 billion budget Corbett signed Thursday does not increase state taxes while authorizing $871 million in new spending, largely for public schools, prisons, pension obligations, health care for the poor and social safety-net programs.

To plug the deficit, it relies on more than $2.5 billion in one-time stopgaps, the biggest use of stopgaps outside of the three years around the Great Recession.

The main appropriations bill passed without a single vote from a Democrat.

Lawmakers made no immediate indication of how they would respond to the line-item vetoes, or whether they would move up planned return dates of Aug. 4 for the House and Sept. 15 for the Senate.

There are two reasons Gov. Corbett is choosing to take a stand now. I’ve already mentioned the first one: lawmakers leave for the summer after the budget is passed and don’t return until as late as September 15. Corbett wants to get them back to the capitol to pass pension reform.

But the second reason is this: Gov. Corbett is facing an upcoming election—and he’s currently trailing in polls behind his Democratic challenger, Tom Wolf.

So if some of this feels like campaign theater, it’s because it probably is. In fact, the political calculus behind Corbett’s recent decisions is one of the more fascinating aspects of this story.

Consider that Corbett could have vetoed the budget entirely, a move that would certainly rile lawmakers and get them back from their summer vacations. But the move would have riled the electorate, too:

A full veto would affect many stakeholders, though most employees would get paid. It potentially could delay money for groups receiving millions of dollars from the state, particularly social services such as day care providers hit hard in 2009 during a 101-day budget impasse under ex-Gov. Ed Rendell.

Corbett wants to be seen as taking a stand to save the state’s finances, not sabotage them. Line item vetoes are a less reckless way of accomplishing that goal.

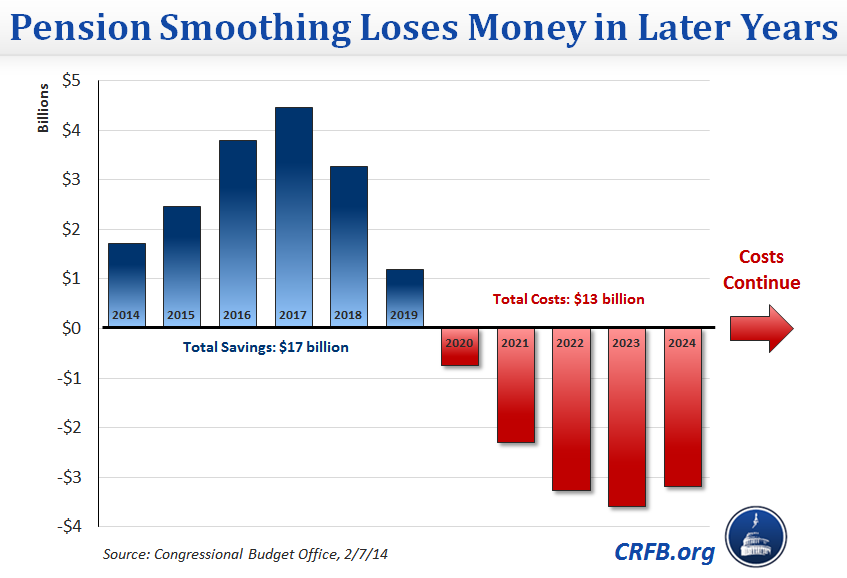

Political maneuvering aside, Corbett has a point. Pennsylvania’s pension system, as is true in many states, is a fiscal hazard that will only get worse as time goes on:

If lawmakers don’t find a solution to what Corbett calls a pension crisis, costs will steadily rise for taxpayers. Pennsylvania will raise payments into the state’s pension systems by $600 million in the new budget year. The state has $47 billion in unfunded liability in pension obligations.

If you asked Corbett about his line item vetoes, he would probably tell you that, in fact, deep cuts to social services spending will be the new norm if lawmakers can’t get pension costs under control.

Corbett’s actions are making him enemies with lawmakers on both sides of the aisle:

[Democrats accused] Corbett of lacking leadership skills and mishandling the state’s finances while pursuing school funding cuts that they say accelerated school property tax hikes.

“Tom Corbett made this mess,” House Minority Leader Frank Dermody, D-Allegheny, said. “He owns it.”

Republicans stressed that they had worked hard to pass a pension overhaul.

House Majority Leader Mike Turzai, R-Allegheny, said the leading pension bill was hatched by House Republicans, not Corbett, while the Senate’s four top Republicans suggested Corbett had been reckless.

“The state budget process is not a game to be played and vital government programs should never be placed in jeopardy,” they said in a statement.

Pension360 will keep you updated on this story as it plays out over the next few weeks.

Photo by Chesapeake Bay Program via Flickr CC