Bayerische Versorgungskammer (BVK), Germany’s largest manager of public pension assets, indicated this week that some major allocation changes could be coming to the fund.

Among the changes: doubling its private equity investments (from 4 percent of assets to 8 percent) and trimming its fixed-income holdings (from 60 percent of assets to 50 percent).

From Bloomberg:

Germany’s biggest public pension fund plans to invest more in private equity and hedge funds and reduce its bond holdings as low interest rates curb returns.

“We started committing the first funds to private equity in 2007 and we are now beginning to reap the first rewards,” said Andre Heimrich, chief investment officer of Bayerische Versorgungskammer, in an interview in Munich. “There is still room for expansion and we could imagine doubling our share of private-equity investments.” BVK currently has about 4 percent of its assets committed to buyout funds.

[…]

“The current low interest rate environment will persist for some time,” said Heimrich, who took over as CIO from Daniel Just, now BVK’s chief executive officer, in February 2013. “In Germany, we even might not have reached rock bottom yet.”

As a result, BVK plans to reduce fixed-income holdings, such as government bonds and covered bonds, to about 50 percent of its investments from 60 percent at present, Heimrich said.

Heimrich also outlined his expectations for returns. From Bloomberg:

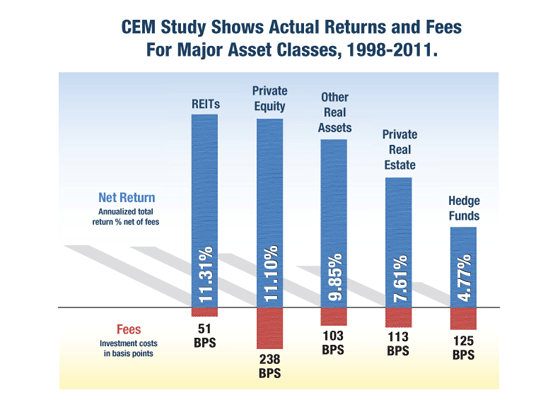

BVK invests in private equity through firms including Pantheon International Participations Plc, a British investor in leveraged buyout firms. The first investments have seen annual returns of more than 10 percent, Heimrich said.

That compares with an expected return of about 7 percent on infrastructure investments, where BVK has placed about 3 percent of its assets through specialized funds that hold stakes in the likes of airports, harbors, electricity meters and prisons.

“We would like to do much more, but there are way too few projects on offer,” Heimrich said. “It would be a perfect asset class for us due to its long duration and above-average returns.”

BVK expects an average return on investment of 4 percent this year, higher than the minimum needed to meet commitments to pensioners, currently at about 3.7 percent, Heimrich said.

Apart from investing in real estate funds, BVK has been providing direct lending to commercial real estate projects as banks left an opening in recent years. It provided about 190 million euros in financing for the so-called Silver Tower in Frankfurt in 2011, 300 million euros for Tower 185 in the same city in 2013 and 450 million euros for shopping center Mall of Berlin this year. Two global real estate investment trusts, in which BVK invested about 500 million euros this year, have returned more than 10 percent by the end of August, he said.

BVK manages $76.5 billion in assets for 12 of Germany’s public pension plans.