A new poll conducted by Wells Fargo has affirmed what other recent surveys have already found: many Americans are putting off saving for retirement, and a significant percentage of people have no retirement savings at all.

This survey is of interest because it focused specifically on middle-class Americans.

The results:

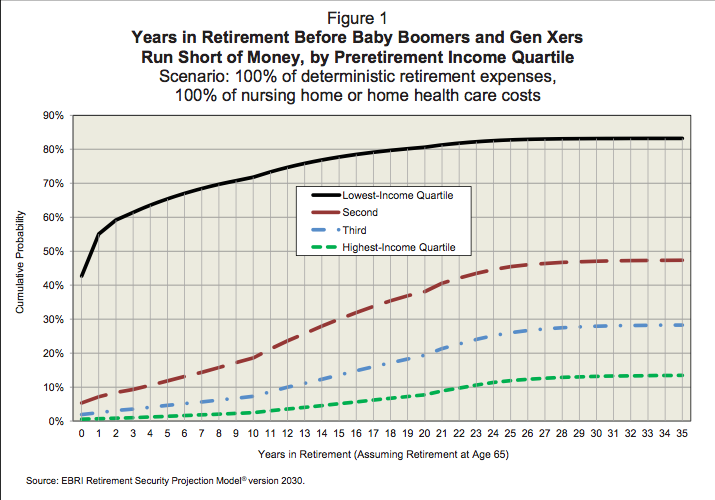

Forty-one percent of middle-class Americans between the ages of 50 and 59 are not currently saving for retirement. Nearly a third (31%) of all respondents say they will not have enough money to “survive” on in retirement, and this increases to nearly half (48%) of middle-class Americans in their 50s. Nineteen percent of all respondents have no retirement savings. On behalf of Wells Fargo, Harris Poll conducted 1,001 telephone interviews from July 20 to August 25, 2014 of middle-class Americans between the ages of 25 and 75 with a median household income of $63,000.

Sixty-eight percent of all respondents affirm that saving for retirement is “harder than I anticipated.” Perhaps the difficulty has caused more than half (55%) to say they plan to save “later” for retirement in order to “make up for not saving enough now.” For those between the ages of 30 and 49, 59% say they plan to save later to make up retirement savings, and 27% are not currently contributing savings to a retirement plan or account.

Sixty-one percent of all middle-class Americans, across all income levels included in the survey, admit they are not sacrificing “a lot” to save for retirement, whereas 38% say that they are sacrificing to save money for retirement.

[…]

While a majority of middle-class Americans say that they are not sacrificing a lot to save for retirement, 72% of all middle-class Americans say they should have started saving earlier for retirement, up from 65% in 2013. When respondents were asked if they would cut spending “tomorrow” in certain areas in order to save for retirement, half said they would: 56% say they would give up treating themselves to indulgences like spa treatments, jewelry, or impulse purchases; 55% say they’d cut eating out at restaurants “as often”; and 51% say they would give up a major purchase like a car, a computer or a home renovation. Notably, fewer people (38%) report that they would forgo a vacation to save for retirement.

The survey also asked people how much money they had saved:

According to the survey, middle-class Americans have saved a median of $20,000, which is down from $25,000 in 2013. Middle-class Americans across all age groups in the study expect to need a median savings of $250,000 for retirement, but they are currently saving only a median amount of $125 each month. Excluding younger middle-class Americans who may be earning less money, respondents between the ages of 30 and 49 are putting away a median amount of $200 each month for retirement, whereas those between the ages of 50 and 59 are putting away a median of $78 each month for retirement.

Twenty-eight percent of all age groups included in the survey report that they have a written financial plan for retirement. That number is slightly higher, 34%, for those between the ages of 30 and 39. People with a written plan for retirement are saving a median of $250 per month, far greater than the median $100 per month that is being saved by those without a written plan.

The entire report can be read here.

Photo by www.SeniorLiving.Org