Over at the STUMP blog, actuary Mary Pat Campbell dove into Chicago’s pension troubles and its “asset death spiral” in a recent post.

It is reprinted below.

_________________________

Public Pension Watch: How Screwed is Chicago?

SPOILER ALERT: a lot.

Let me point out some language from a recent official report:

Going forward, the Plan’s ability to meet its return objective over the long term will continue to be challenged as invested assets are liquidated to pay monthly benefits. During fiscal year 2013, $496.3 million or approximately 9.8% of the investment portfolio was liquidated to assist in meeting benefit payment obligations. [page 7]

…..

Plan Net Position Restricted for Pension Benefits, as reported in the Statements of Plan Net Position totaled $5,421.7 million, an increase of $239.0 million or 4.6 percent from the prior year. The growth in assets would have been significantly higher if approximately $496.3 million in portfolio assets were not liquidated to supplement the disbursement of benefit payments during the year. [page 14]

…..

Having a negative impact on asset values was the need to liquidate investments to pay benefits on a monthly basis. In all, MEABF liquidated $496.3 million of investments to meet the Plan’s cash flow needs. [page 18]

…..

The Actuary projects that under the current funding policy, if all future assumptions are realized, the funding ratio is projected to deteriorate until assets are depleted within about 10 to 15 years. The current statutory funding mechanism impacts the ability to grow assets because in order to pay benefits, assets have and will continue to be liquidated.[page 20]

…..

In other words, $496.3 million had to be liquidated from the investment portfolio in 2013 to cover the shortfall. Without sufficient contributions, annual funding deficits will grow and overwhelm the Plan over time. [page 56]

…..

The current statutory funding policy impacts the ability to achieve higher returns over the long-term because it is projected that assets may need to be liquidated in order to pay annual benefits. This could result in a change in the asset allocation in the future to more liquid assets with a lower return. We recommend that the funding policy and assumed investment return be reviewed every year. If the funding policy is not strengthened to an appropriate level within the next year, the current investment return assumption will not be supportable for financial reporting purposes. [page 90]

Ah, the asset death spiral.

This is from the Comprehensive Annual Financial Report of the Municipal Employees’ Annuity and Benefit Fund of Chicago for the fiscal year ending December 31, 2013 (and 2012, but that’s an item I don’t want to touch right now.)

Let me explain the asset death spiral, which is when balance sheet weakness manifests itself in something really serious: a lack of cash flow to cover promised benefits.

Having to liquidate assets to cover cash flows is not necessarily a bad sign — if one has a decreasing liability (which means decreasing cash flow needs in the future).

This is not the case for Chicago. Nor Illinois.

One has to sell off assets when investment returns and pension contributions are too low to cover current cash flow needs. This reduces the asset amount for the pension funds…and if cash flow needs are increasing, you find that one has to liquidate more and more assets… until the fund is exhausted.

Remember that the equity markets did extremely well in 2012 and 2013…. and this pension fund had to liquidate almost 10% of its assets to cover cash flows. This is not good.

Let’s see what the incoming city treasurer has to say:

Mayor Rahm Emanuel’s choice to replace retired City Treasurer Stephanie Neely vowed Tuesday to do his part to help solve Chicago’s $20 billion pension crisis — by improving investment returns and reducing millions of dollars in fees paid to investment managers.

The full City Council is expected to ratify the appointment of Kurt Summers at Wednesday’s meeting, but the incoming treasurer is not waiting for the vote before rolling up his sleeves and getting to work.

He’s already meeting with actuaries and pouring over the books of the four city employee pension funds.

They include the Municipal Employees and Laborers funds that have already been reformed and police and fire pension funds still waiting for similar action.

In 2016, the city is required by law to make a $550 million contribution to shore up police and fire pension funds with assets to cover just 29.6 and 24 percent of their respective liabilities.

…..

“One fund is paying 80 percent more in fees. Another is paying 50 percent more. Yet, there’s one client: The city of Chicago. That’s real money. For fire, the value of that is about $2.5 million-a-year on $1 billion in assets,” he said.

“These kinds of things aren’t going to solve the kinds of holes we have. But any benefit we can find to invest more efficiently and less expensively is a benefit to taxpayers and retirees.”

Summers noted that the bill that saved the Municipal and Laborers Pension funds — by increasing employee contributions by 29 percent and reducing employee benefits — assumes an “actuarial rate of return” on investments of 7.5 percent-a-year.

That makes it imperative that the funds invest in the “right type of assets,” he said.

……

“It’s a common misconception to say, `If I invest in the markets or fixed-income [instruments], we’re gonna be protected, but real estate, private equity or hedge funds are risky.’ That’s plain wrong,” Summers said.

“The reality is, you have just as much, if not more exposure to risk and volatility in the market with investments in basic public securities than you do with alternative products meant to mitigate risk and limit volatility. That’s the business I was in — trying to do that for clients around the world.”

:facepalm:

While I don’t necessarily have an issue with public pensions investing in equities of various sorts (whether domestic, emerging economies, private, or whatever), and while I definitely have no problem with making sure public plans aren’t getting gouged in fees, the problem is not that the pension funds are in the “wrong type of assets” or that the fees are too high.

It’s that too much has been promised and too little has been paid towards those promises.

Can Chicago dig itself out of its pension hole?

Chicago’s pension debacle was largely precipitated by the fact that the payment schedule is determined by the state legislature rather than by complying with Government Accounting Standards Board (GASB) requirements. The state has a long history of exempting itself and Chicago from annual pension-contribution requirements.

According to a recent Pioneer Institute study that I mentioned in my last post here, “It is hard to imagine how Chicago can avoid a full-blown Detroit scenario … within the next 10-15 years unless the city both 1) finds a way to cut existing benefits and obligations and 2) starts contributing substantially more to its pension plans right away.”

Under state law, Chicago will be required to more than double that $476 million pension contribution by 2016, and the annual tab is scheduled to continue rising rapidly after that. The city says it can’t afford the higher contribution, but even the new payment is barely half of the $2.2 billion payment Chicago should make according to GASB rules.

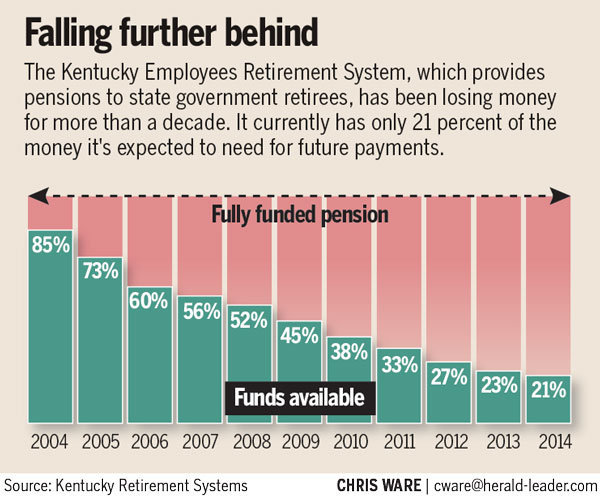

The city plans to delay increasing its contributions in hopes that the legislature will enact changes to reduce the required payments. But while it’s important for the city to take the time needed to craft a comprehensive solution to its pension problem, waiting for state help doesn’t make much sense. Illinois faces the biggest pension crisis of any state, with $100 billion of its own unfunded obligations.

…..

Together with radical pension contribution increases, the city will need to significantly cut the cost of its existing obligations. If the courts find that such a move runs afoul of the Illinois constitution, Chicago will find itself a long way down the frightening path that leads to becoming the next Detroit.

Good luck with that.

I’m not seeing how they’re going to squeeze extra taxes out of Chicago residents, when one third of them are living paycheck-to-paycheck.