Last month, current Rhode Island Treasurer Gina Raimondo (Democrat) denied the Providence Journal access to records relating to the state pension fund’s hedge fund investments.

The newspaper appealed, but that appeal was denied as well.

In a letter written by Raimondo at the time of the denial, she justified her actions with the following logic (the entire letter can be read at the bottom of this post):

For democracy to work, the public, often through the press, needs oversight over how government is acting on its behalf. At the same time, the government, to fulfill its obligations to the public, needs to be able to function effectively, which often requires a measure of confidentiality, particularly when contracting with private sector entities. Over the years, the law has determined how to balance these two requirements, and the actions of Treasury were consistent with that balance.

With elections only a few months away, and Raimondo in the midst of a bid for governorship of the state, Raimondo’s opponents have seized the opportunity to pounce on her decision to deny access to the hedge fund records.

Providence Mayor Angel Taveras (Democrat), who is now running for governor of the state, had this to say:

“Apparently, the treasurer is more concerned about hedge funds being able to keep their talent than taxpayers knowing how their money is being spent,” Taveras’ spokeswoman Dawn Bergantino said. “The treasurer should be looking out for our interests, not Wall Street and hedge fund billionaires.”

Allan Fung (Republican) is currently the mayor of Cranston, Rhode Island. But he’s in the running for governor of the state as well, so he put his thoughts on the table:

“There is a dramatic difference between what is required legally and what is necessary to do the right thing,” Fung said. “Current and retired state employees depend on the strength of the pension fund for their retirement security, and all Rhode Islanders face the risk of higher taxpayer contributions if these investments come up short. We all face tremendous risk and we deserve to know the basis for these investments.”

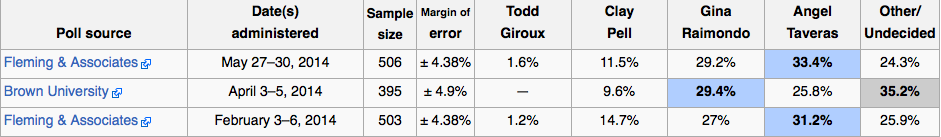

According to the latest polls, Taveras is currently up on Raimondo, garnering 33.4 percent of the vote to Raimondo’s 29 percent. Clay Pell remains a distant third with 11.5 percent of the vote.

Raimondo’s position has notably diminished since she chose to withhold the hedge fund records. Although she is drawing in the same percentage of votes, the issue may have swayed undecided voters to side with Taveras.

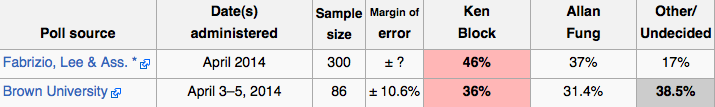

On the Republican side, the latest poll has Ken Block maintaining a healthy lead over rival Allan Fung.

And, as promised, here is the letter that Raimondo wrote when she denied the Providence Journal access to the state pension fund’s hedge fund records.

[iframe src=”<p style=” margin: 12px auto 6px auto; font-family: Helvetica,Arial,Sans-serif; font-style: normal; font-variant: normal; font-weight: normal; font-size: 14px; line-height: normal; font-size-adjust: none; font-stretch: normal; -x-system-font: none; display: block;”> <a title=”View RI letter on Scribd” href=”http://www.scribd.com/doc/235966120/RI-letter” style=”text-decoration: underline;” >RI letter</a></p><iframe class=”scribd_iframe_embed” src=”//www.scribd.com/embeds/235966120/content?start_page=1&view_mode=scroll&show_recommendations=true” data-auto-height=”false” data-aspect-ratio=”undefined” scrolling=”no” id=”doc_59157″ width=”100%” height=”600″ frameborder=”0″></iframe>”]

Photo by: By Jim Jones (Own work) via Wikimedia Commons