New Jersey is one of the most active states in the country when it comes to investing pension fund assets in hedge funds. That strategy carries risks and boatloads of fees—but it also carries potentially big returns.

Journalist David Sirota investigated the state’s investment decisions and the corresponding return data. He found that New Jersey was certainly straddled with management fees.

But the promised returns have not yet materialized. From Sirota:

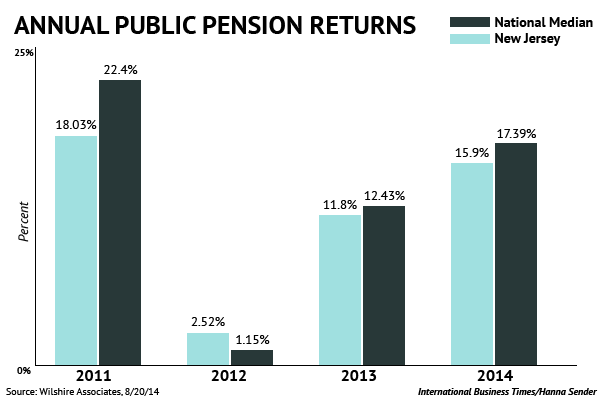

Between fiscal year 2011 and 2014, the state’s pension trailed the median returns for similarly sized public pension systems throughout the country, according to data from the financial analysis firm, Wilshire Associates. That below-median performance has cost New Jersey taxpayers billions in unrealized gains and has left the pension system on shaky ground.

Meanwhile, New Jersey is now paying a quarter-billion dollars in additional annual fees to Wall Street firms — many of whose employees have financially supported Republican groups backing Christie’s reelection campaign.

Neither Christie nor the state pension fund’s top investment official responded to Sirota’s requests for comment. But to a certain extent, the numbers speak for themselves. Here’s a chart of the state’s management fees since 2009:

More from Sirota:

In 2009, the year before Christie took office, New Jersey spent $125.1 million on financial management fees. In 2013, the most recent year for which data is available, the state reported spending $398.7 million on such fees. In all, New Jersey’s pension system has spent $939.8 million on financial fees between fiscal year 2010 and 2013.

That’s only a little less than the amount Christie cut from state education funding in 2010 — a cut that played a major role in shrinking the state’s teaching force by 4,500 teachers. That money might also have reduced the amount the state needs to pay into the pension system to keep it solvent.

That last part, bolded, is important. A major catalyst behind New Jersey’s incoming round of pension reforms was the state’s towering pension payments. Christie decided to divert money from those payments to plug holes in the general budget.

But that decision decreased the health of the state’s pension systems, and Christie now intends to introduce another series of reforms which will likely focus on cuts to benefits.

As you can see, there’s a lot of cause-and-effect reverberating throughout New Jersey’s pension system right now.

Sirota has much more on this situation in his article, which you can read here.