It’s become a tradition for politicians of either party: on the campaign trail, at some point, you need to accuse your challenger of dodging taxes. The race for Illinois governor is no exception, but there’s an interesting spin on this one.

Current Illinois Gov. Pat Quinn earlier this week accused wealthy challenger Bruce Rauner of dodging U.S. taxes by placing his money in offshore accounts in the Cayman Islands.

A Chicago Tribune investigation had previously revealed that Rauner paid a tax rate of around 15 percent on much of his fortune, even though his wealth made him eligible for tax brackets above 30 percent.

But Rauner fought back, first claiming that his offshore investments did not impact the tax rate he paid. Then, he claimed Quinn himself had money in the Caymans. His pension, to be exact.

Rauner claims that Illinois pension funds have hundreds of millions of dollars in Cayman-based investments.

From the Chicago Sun-Times:

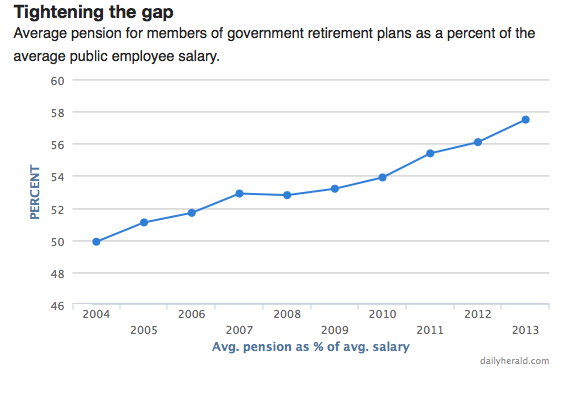

Rauner’s campaign said the Teachers Retirement System has invested $433.5 million in Cayman Islands-based funds while the State Board of Investment has $2.3 billion in offshore holdings, which includes some Caymans-related funds though the agency could not specify how much.

Both are tax-exempt entities and, unlike individual investors, derive no direct tax benefit from investing in funds based there, spokesmen for both agencies said. TRS invests on behalf of current and retired suburban and downstate teachers. The State Board of Investment oversees pension investments for current and retired state workers, university employees, judges, lawmakers and state officials, including the governor.

“If Pat Quinn refuses to apologize and tell the truth, he should immediately move to divest all state investments from companies and funds domiciled overseas, including in the Cayman Islands,” Rauner’s campaign said.

As was bolded, pensions systems are tax-exempt and so there’s no tax benefit from putting money offshore.

Quinn’s camp, when pushed for a statement, declined to say whether Quinn would like the pension systems to stop investment in Cayman-related funds. But the Governors spokeswoman told the Sun-Times:

“The governor has no authority to direct pension fund investments, and he’s not about to start getting involved. That’s really not the issue.”