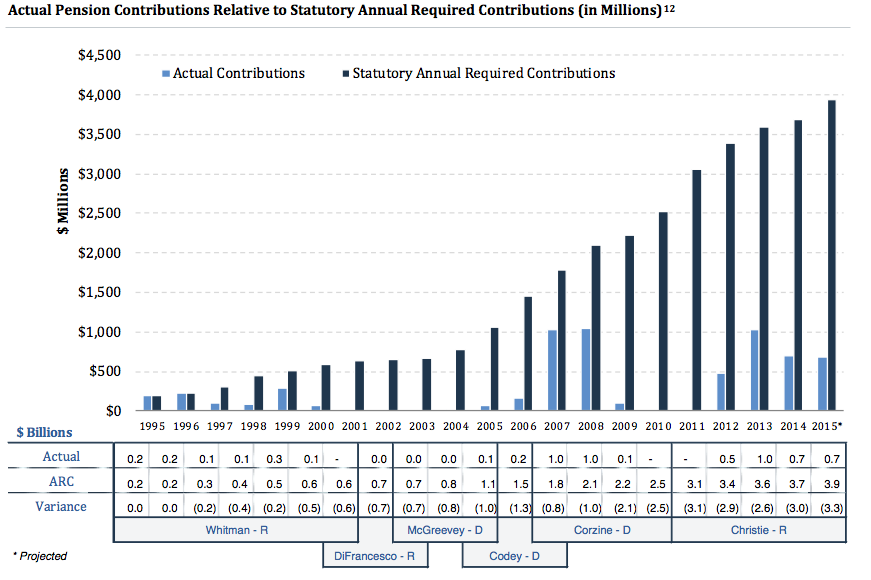

Fixing New Jersey’s pension system has been the talk of the state lately, and as far as ideas go, all the usual suspects have been proposed: cutting benefits, making full actuarial contributions, transferring new hires into a 401(k)-style plan, etc.

One idea that is rarely discussed is the creation of a model similar to New York: the appointment of a comptroller to oversee and have authority over the pension system.

Under this model, the comptroller would take significant authority out of the governor’s hands regarding pension matters.

This hypothetical comptroller, if he wished, could have overridden Chris Christie’s decision to cut the state’s pension payments. More analysis from NJ Spotlight:

While New Jersey governors and legislatures have been cutting, skipping, or underfunding pension payments for the past 20 years, New York does not have a similar pension crisis because its elected state comptroller has the power not only to set the actuarially required pension payment each year, but also to require Albany’s governor and Legislature to fully fund it, according to a senior Moody’s Investors Service analyst.

New York State Comptroller Thomas DiNapoli is required to calculate the state’s pension payment by October 15 to give the governor’s office and legislative branch sufficient time to include his calculation in the budget for the fiscal year that begins the following June 30. That amount is then required to be paid into the state’s pension systems on or before March 1 — three months before the end of the fiscal year.

“In New York, the state comptroller is responsible for the entire pension system,” Robert Kurtter, Moody’s Managing Director for U.S. Public Finance, explained at a forum on pension funding at Kean University last week. “The comptroller’s power to require full pension funding has been litigated and upheld by New York’s highest Court of Appeals.

“The New York Legislature tried to underfund the actuarially required contribution, but couldn’t,” Kurtter said. “It’s a two-edged sword for New York. Their unfunded liability is low, but they don’t have a choice, even when revenues are down.”

The soundness of New York’s pension system is one of the principal reasons that the state enjoys a AA1 bond rating from Moody’s — one of 30 states in the top two rating categories — while Illinois and New Jersey are the nation’s fiscal basket cases, the only two states with lower-tier single-A bond ratings. While New York was upgraded this year, New Jersey’s bond rating has been downgraded a record eight times under Gov. Chris Christie.

But creating a comptroller position and giving it authority is a politically tricky process – because it involves not only amending the constitution, but also taking away significant power from the state’s governor. From NJ Spotlight:

New Jersey’s governor has more power over state spending than any other governor. New Jersey’s governor has unilateral authority to determine the revenue projections that determine the size of the budget — which Christie has consistently overestimated, as previous governors have when it met their political needs.

New Jersey’s governor also has the ability to make midyear budget cuts without seeking legislative approval — as Christie did when he retroactively changed the pension formula in March and cut $900 million in Fiscal Year 2014 pension payments in May.

Adding an elected state comptroller or state treasurer or establishing an ironclad requirement that the state make its actuarially required contributions to the pension system annually would require a constitutional amendment. The Democratic-controlled Legislature would need the governor’s signature to pass a new law, but not to put a constitutional amendment on the ballot — a strategy it used to bypass Christie on the minimum wage last year and on guaranteed funding for open space this fall.

Last spring, Christie cut $2.4 billion in payments to the pension system and diverted it to help balance the state’s general budget.