Kentucky State Rep. Jim Wayne has introduced legislation that would infuse a ray of transparency into the state’s retirement systems, including KRS, a system oft criticized for its opaque practices.

From the Independent:

The legislation, Bill Request 91, would require state-administered retirement systems to operate under the state procurement laws, which includes making contracts public. It would also prohibit the use of placement agents, intermediaries who have been involved in pay to play scandals in other states.

The legislation also seeks to tighten requirements for KRS board members appointed by the governor to ensure they have appropriate investment expertise. The current low-qualified “investment experts” on the board refused to comment on any investment issues for the Kentucky Center for Investigative Reporting story, Wayne said. He added the two investment experts on the board need to be knowledgeable, independent and willing to be accountable to the public.

[…]

“The current model smacks of the good ol’ boy system,” said Wayne, D-Louisville. “The system is closed. A small group decides behind closed doors who gets to manage billions of dollars in public money and what they’ll get paid for it, no questions allowed. That’s just way to chummy for my tastes.”

The urgency for such legislation was illustrated after two journalism organizations investigating the pension plans during the summer were denied information on fees and even the names of individual managers, Wayne said.

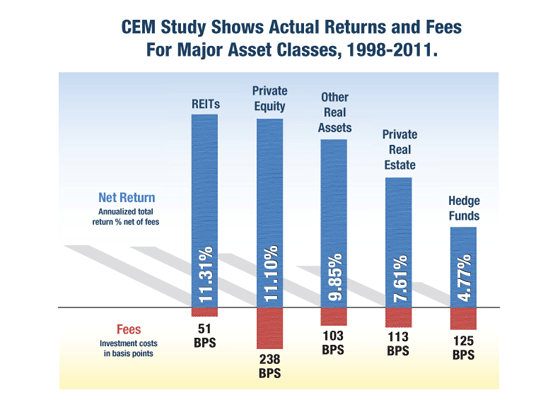

The Lexington Herald-Leader reported June 14 that KRS spent at least $31 million on managers of hedge funds, private equity, real estate and other “alternative investments” that hold just one-fourth of the system’s $15 million in assets and produced its lowest returns.

A July 24 report by the Kentucky Center for Investigative Reporting in Louisville found KRS potentially spent $156 million in mostly undisclosed fees to these “alternative investments.”

Wayne added one more comment:

“The health and well-being of public employee retirement systems should not be shrouded in mystery,” said Wayne. “No one should be required to invest their hard-earned money in a system that is not fully transparent. Not only should public employees know if the systems are financially stable, the taxpayers should also know.”

The Kentucky Retirement Systems holds $16 billion in assets and is about 45 percent funded, although certain parts of the system are unhealthier.

KRS allocates about 35 percent of its assets toward alternative investments, including real estate; the nationwide average is 25 percent, according to data from Cliffwater LLC.