For the second straight year, Russia has decided to freeze its contributions to its pension funds and instead use the money to plug budget holes elsewhere.

Russia says the money will be used for more pressing needs elsewhere in the budget. But critics claim the action could be a costly one. Russia Beyond The Headlines reports:

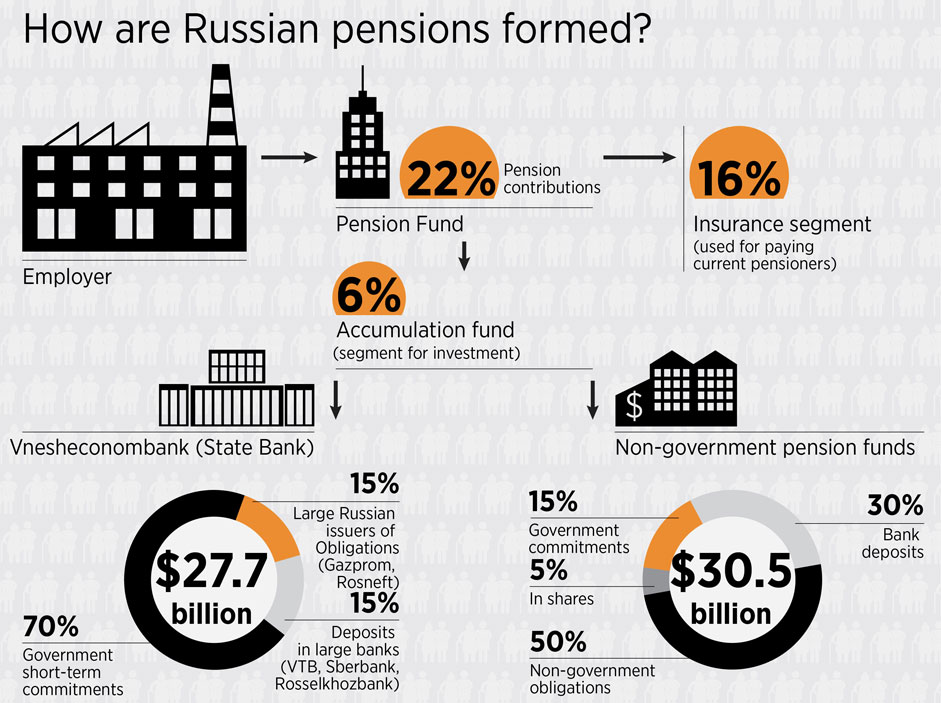

For the second year in a row, the Russian government has decided to freeze the portion of pension contributions allocated for investment.

Contributions for 2013, amounting to some 550 billion rubles ($15.2 billion), have already been frozen, with the government intending to do the same with a further 700 billion rubles’ worth of pension savings for 2014.

The move, which the Ministry of Labor and Social Protection says is necessary in order to finance current pension payments, will leave major Russian companies without investment and will force banks to raise interest rates.

The negative effects are already being felt by ordinary Russians: At the end of last year, minimal interest rates for individuals started at 8 percent, whereas in 2014 loans have become 2 percent more expensive, with interest rates starting at 10 percent.

This year’s situation will be further exacerbated by the departure of foreign investors, Baranov adds.

“This will result in the cost of loans and debt refinancing growing in 2015 for banks and corporations, for the federal and regional finance ministries. It is hard to estimate the exact figure that they will have to pay extra, but it will be comparable with the amount of frozen funds, i.e. the very same 700 billion rubles or maybe even more,” Baranov says, predicting the potential consequences.

Russia’s pension funding is experiencing turbulence due to a demographic shift that has more people retiring and less people contributing to the system. From RBTH:

Sergei Khestanov, an economist for the ALOR Group, explains that the deficit in the Pension Fund has occurred because of the country’s demographic decline. The population is aging, and while 20-30 years ago there were 6 workers to one pensioner, now there are fewer than two, and their contributions do not cover current needs.

That demographic shift won’t be reversing itself anytime soon. So while the pension freeze helps plug current shortfalls, it only exacerbates future problems.

Reuters reported earlier this month that there was “deep disagreement” among Russian officials regarding the contribution freeze.