The UK’s Universities Superannuation Scheme (USS), the country’s largest pension fund, is preparing for the possibility that its unfunded liabilities could be larger than reported, and its financial condition more serious than its 85 percent funding ratio might suggest. From Financial News:

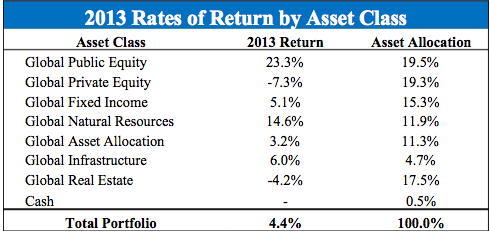

USS pays out £100 million worth of pensions a month, and its team of fund managers and traders in London undertake £1 billion worth of transactions every day. The team beat its targets last year, producing a 7.9% return against benchmark performance of 6.5%, according to its annual report to March 31, 2014, published late Wednesday.

Despite all this, the pension fund is struggling financially. It is currently undertaking a full formal valuation of its assets and liabilities as of 31 March 2014, a lengthy and complex process which it is expected to complete by the end of the year.

The pension scheme has provided an interim estimate of its funding level at the same date – 85%, implying a deficit of around £7 billion. This is a fall from the deficit reported at 31 March 2013 – £11.5 billion – reflecting a recovery in markets in the meantime.

However, USS’s trustees cautioned that the final figure might be “materially” different to £7 billion, and could be larger.

Administrators of the fund, along with labor groups and other parties, are already planning various cutbacks and cost-saving measures to head off the potential news of higher-than-believed liabilities. Reported by Financial News:

The main proposals are to close the old final-salary section of the scheme to its existing members – it was closed to new joiners in 2011 – and to introduce a new cap on the pensions that can be built up under the new career-average benefits section.

At the same time a new defined-contribution section, offering pensions that aren’t guaranteed, would be opened so that any members earning more than the cap can put their extra savings into it.

According to Universities UK’s July proposal: “This threshold has not yet been set but, depending on affordability, Universities UK’s aim is to maximise the number of scheme members who will fall below the salary threshold.”

The Universities Superannuation Scheme became the largest pension fund in the country this year after its assets grew to £41.6 billion.