Last week, the funding ratio of New Jersey’s pension system dropped 20 points. That’s because the state began measuring funding under new GASB accounting rules, which requires using market asset values instead of actuarial ones.

This new way of measuring liabilities puts New Jersey in an even deeper hole. But as Leo Kolivakis of Pension Pulse points out, this is a hole that New Jersey dug for itself – with poor pension governance, below-median investment performance and by diverting state pension payments to other parts of the budget.

Here’s Kolivakis’ take on New Jersey’s situation, the new GASB rules and compensating pension fund staff.

__________________________

Originally published at Pension Pulse:

You can read more on GASB’s new rules for pensions here. I note the background for these changes:

On August 2, 2012, the GASB published accounting and financial reporting standards that improve the way state and local governments report their pension liabilities and expenses, resulting in a more faithful representation of the full impact of these obligations.

The guidance contained in these Statements will change how governments calculate and report the costs and obligations associated with pensions in important ways. It is designed to improve the decision-usefulness of reported pension information and to increase the transparency, consistency, and comparability of pension information across state and local governments.

For example, net pension liabilities will be reported on governments’ balance sheet, providing citizens and other users of these financial reports with a clearer picture of the size and nature of the financial obligations to current and former employees for past services rendered.

In particular, Statement 68 requires governments providing defined benefit pensions to recognize their long-term obligation for pension benefits as a liability for the first time, and to more comprehensively and comparably measure the annual costs of pension benefits.

The new GASB rules will impact all state and local pensions, not just New Jersey. This will be another important measure to determine whether U.S. public pensions are indeed on solid footing.

As for New Jersey, back in March, I commented on its pensiongate scandal and didn’t mince my words:

The article doesn’t capture the real problem at U.S. public pension plans, namely, lack of proper governance. You basically have politicians appointing political bureaucrats in charge of public pensions, paying them peanut salaries and getting monkey results. There are exceptions but this is typically how U.S. public pension funds are mismanaged.

And who benefits most from this? Of course, the Paul Singers, Dan Loebs, Steve Schwarzmans, and all the rest of the who’s who managing hedge funds and private equity funds. It’s one big alternatives party — for the big boys. Everyone is making a killing except for these public pension funds, praying for an alternatives miracle that will never happen. These alternatives managers and their sophisticated marketing are milking the public pension cow dry. They basically have a license to steal.

And why not? There are plenty of dumb institutions listening to their useless investment consultants who are more than happy to recommend the latest hot hedge fund or private equity fund to their ignorant clients. It’s a frigging joke which is why the Oracle of Omaha is 100% right when he warns us that the worst is yet to come for U.S. public pensions.

As far as New Jersey, Gov. Christie has done some good things on pension reform but a lot more needs to be done. Double-dipping pensioners are bleeding New Jersey dry. Unions can bitch all they want about rich alternatives managers meddling in their state’s politics but they must accept shared risk of their plan, which includes raising the retirement age and cuts in benefits as long as the plan is chronically underfunded. The state of New Jersey, however, should make sure it tops up its public pension plan which it neglected to do for years (the major cause of the pension deficit).

The biggest factor explaining the pension deficit in New Jersey and other states is how successive state governments failed to make their pension contributions, using the money to fund other things (no doubt in an effort to buy votes).

But there are plenty of other factors that didn’t help, like lack of sensible pension reforms, lousy investment performance and poor governance.

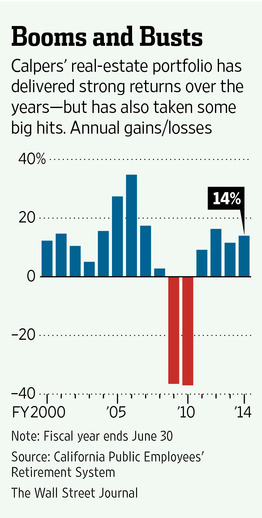

On this last point, Michael B. Marois of Bloomberg reports, California Pension Fund Bonus Payouts Climb 14% From Prior Year:

The $300 billion California Public Employees’ Retirement System, the largest U.S. public pension, paid $9 million in bonuses last fiscal year, up 14 percent from a year earlier as earnings exceeded benchmarks.

The fund, known as Calpers, paid $8.7 million in bonuses to investment staff in the year ended June 30, and almost $300,000 to four non-investment executives, according to data provided by the system. The rewards are based on three-year performance verses a benchmark, as well as the earnings of each asset class and individual portfolios, said spokesman Brad Pacheco.

“These awards are part of the overall compensation we provide to recruit and retain skilled investment professionals needed to ensure success of the fund,” Pacheco said.

Public-pension funds are recouping investment losses suffered during the 18-month recession that ended in June 2009, which wiped out a third of Calpers’ value. Still, the crisis left U.S. pensions short more than an estimated $915 billion needed to cover benefits promised to government workers. Taxpayers have been asked to make up the shortfall.

The biggest bonus earner was Ted Eliopoulos, the chief investment officer who recorded a $305,810 bonus last year in addition to his $412,039 base pay.

Top Job

That bonus was paid when Eliopoulos was acting chief investment officer after his predecessor Joe Dear died in February from cancer. Prior to that, Eliopoulos headed the fund’s real estate portfolio. He now earns $475,000 in base pay after he was tapped for the top investment job in September.

Eliopoulos announced in September that the fund was divesting all $4 billion it had in hedge funds, saying they were too expensive and too complicated and not worth the returns.

The pension fund earned 18.4 percent last fiscal year, 12.5 percent a year earlier and 1 percent in 2012. It estimates it need 7.5 percent annually to meet its long-term obligation to pay benefits promised to state and local government workers.

Calpers is still short $103.6 billion needed to cover those promises based on market value as of June 30, 2012, the latest figure that was available. That shortfall is up 19 percent from a year earlier.

The California fund says it must grant bonuses to help compete with the pay that employees could make if they went to work on Wall Street. Pacheco said spending money on in-house investment management saves about $100 million a year that otherwise would be paid to Wall Street in fees.

Wall Street bonuses, which rose 15 percent on average last year to $164,530 — the highest since 2007 — may climb again as a result of payments deferred from previous years, New York Comptroller Thomas DiNapoli said last month.

Four executives outside the Calpers investment office were paid a total of $295,930 in bonuses last year, the fund said. Anne Stausboll, chief executive officer, got $113,679; Chief Actuary Alan Milligan earned $75,748 and Chief Financial Officer Cheryl Eason was paid $89,703, almost double a year earlier.

Calpers paid a total of $7.9 million in bonuses in the prior fiscal year.

Compensation is part of pension governance and if you ask my expert opinion, CalPERS’ compensation is fair and accurately reflects the market, their performance and their ability to attract and retain professionals to manage billions. The only thing I would change is base it on four-year rolling returns, like they do at Canadian public pension funds.

All this hoopla on compensation at U.S. public pension funds is totally misdirected. I happen to think most U.S. public pension fund managers are grossly underpaid, just like I think some Canadian public pension fund managers are grossly overpaid (read my comment on PSP’s hefty payouts and the subsequent ones on its tricky balancing act and its FY 2014 results which were likely padded by skirting foreign taxes).

Getting compensation right is critical to the long-term health of any public pension fund but supervisors of these funds should make sure they’re paying their senior investment staff properly based on benchmarks that truly reflect the risks they’re taking. I believe in paying people for performance, not for taking dumb risks to trounce their silly benchmark (that contributed to Caisse’s ABCP disaster which the media is still covering up).