Forbes released an interview Thursday morning with Anthony Scaramucci, founder and co-managing partner of alternatives investment firm SkyBridge Capital.

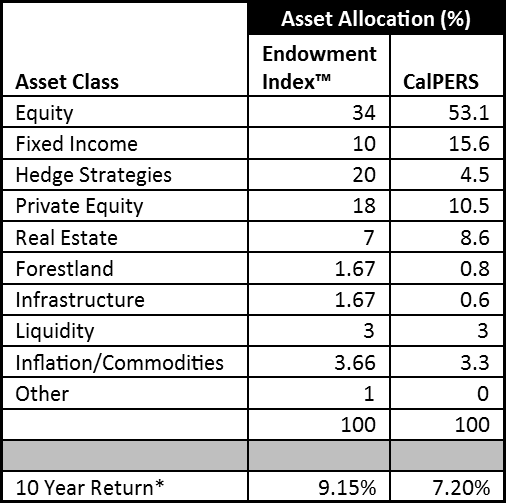

The interview touched on CalPERS’ hedge fund exit, how the pension fund picked the wrong managers and how to pick the right ones. Later, Scaramucci touched on justifying the industry’s fee structure.

On CalPERS’ pullout:

Steve Forbes: Thank you, Anthony, for joining us. To begin, in terms of hedge funds, as you know the overall performance of hedge funds has lagged the market in recent years. CalPERS, the largest hedge fund in the country, made headlines by saying, “We’re getting out of this.” What is that a sign of? Either the hedge fund industry is going away and is only sustained because there’s nothing else around that’s suppressing interest rates or is this a sign of the bottom? When a big one gets out does that mean this is the time to get in?

Anthony Scaramucci: Well, so, the question’s is it going to get easier or harder from here? That was a good start, Steve. But the short answer is that there’s a lot of reasons why the industry’s underperformed. The main one has to do with something you often talk about, which is Federal Reserve monetary policy.

So, the policy since March of 2009 has been to hammer down the rates, artificially stimulate the market. This makes it impossible for about 40% of the hedge fund managers to perform. If you look at the overall hedge fund manager index, 40% of it is in long-short managers.

And so if you’re long something, you’re doing great in this market. But I’ve got to tell you something, Steve. If you’re short something, even if you’re right on the security analytics, you’re going to be wrong on the momentum of the market. And so what’s happened to the long-short managers is the longs are going up, the shorts are going up, and they have this little tight spread. They’re making 3%, 4%, 5% when the market’s rip roaring and the media is writing all these nasty articles about them.

But there are places to make money. There’s structured credit, activism. There’s a whole host of distressed guys that have done well over the last six years. But I think the media has been justified in pointing out that, in general, the hedge funds have not done well.

The CalPERS thing is a little different. They only had 1.5% of their assets there. Joe Dear, who was a legendary guy at CalPERS, when he passed I think it became one of those things where they weren’t going to get bigger for political reasons, and so they decided to get way smaller. But I don’t think it’s a death knell of the industry yet. In fact, I’ll make a prediction that we’ll look back two or three years from now and say that they caught the bottom of the hedge fund performance market.

On manager selection:

Forbes: You said that they [CalPERS] picked the wrong hedge fund managers.

Scaramucci: Yes.

Forbes: How do you pick the right ones? Because it’s fine to say, “Well, if you look at the top 10%, you would have done nifty.”

Scaramucci: Yes.

Forbes: But, like, the top 10% of stocks, how do you do it on a consistent basis?

Scaramucci: Well, okay. So, not to use a baseball analogy, but just think of it this way.

Forbes: You can, I’m a fan.

Scaramucci: Okay. So, well then you’ll probably know this from the Bill James Abstracts. Sixty percent of the everyday players are batting .260 or below, yet every midsummer classic we see 40 guys on the field that are Hall of Famers or the top of what they do. And I think that’s indicative of most industries, frankly, whether it’s the media, the hedge fund industry or, you know, political landscape and so forth. And so there are certain metrics that you can use to identify who’s going to do well. But the number one metric is the macro environment.

If you tell us what the economic dashboard looks like over the next 12 to 18 months, we have pretty high capabilities on the prediction side of what sectors are going to do well. As an example, 2009, if you and I were having this conversation, I would have told you that the residential mortgage-backed security market was going to do very, very well. Those assets were distressed. They were technically oversold by the large institutions. The Federal Reserve monetary policy at that time with Helicopter Ben bringing things down so aggressively, that was going to be an easy place to make money.

And so if you looked at SkyBridge at that period of time, we had about 45% of our assets there. So, the first factor is the macroeconomic factor. The second factor then is, once you figured out what sector you’re going to be in, who are the best guys in that sector and why are they the best? And frankly, a lot of them will be different depending on different markets. Some guys are longer than others. They’ll always be longer. Lee Cooperman is an example of that. If you’re a bull on the market, Lee’s a good bet. It’s that sort of thing.

On the fee structure of hedge funds:

Forbes: You’re a fund of funds, so to speak.

Scaramucci: Yes. Yes.

Forbes: And you know the rap, hedge funds 2%, 20%.

Scaramucci: Sure.

Forbes: Now your fees 1.5%, whatever it is, on top of that.

Scaramucci: Yes. Yes.

Forbes: How do you justify your existence?

Scaramucci: Well, listen. We’re up there with child molesters with most people, so I’ve got a hard time in justifying my existence at times. But I tell people the same thing that I think you would tell them if you were in my seat. Focus on net performance.

If you’re worried about fees, well then you certainly shouldn’t be in the hedge fund industry. But I think what we’ve proven, if you look at our long-term track record, we can help clients get to their actuarial goals by taking less risk, or less beta, if you will.

And so our performance is high single-digit, low double-digit over the last ten years with relatively low volatility. And so I think we’ve been able to justify that. But we did shift our model. I often talk about hedge fund fund of funds 3.0 in the sense that we’re viewing ourselves more like a multi-strat now. We look at the macro environment rather than trying to hug the index, like some of our peers.

The typical fund of funds got a bad rap because they weren’t doing the due diligence. And then they give you 50 managers. They’d give you a 2% in each of those managers. And you’d be hugging the index on your way to mediocrity. What we’ve tried to do, is we’ve tried to concentrate our portfolio on things that we think are working. We have a dynamic approach, where we will move out of securities or move out of hedge funds quickly if we think the market environment has changed. And we believe in concentration.

So, the top ten managers for us, Steve, are about 65% of the assets. And I think that’s differentiated us from our peer group. One last point, if you don’t mind me making it is that, if I’m giving a billion dollars out to somebody, if SkyBridge is giving out a billion dollars, we’re asking for fee concessions. And so we pass those on to our investors. So, even though we have all these loaded fees, so to speak, we’re giving back 75, 80 basis points a year in fee concessions, which I think is meaningful.

The entire interview can be read here.